Bidder Privacy in Auctions

Introduction

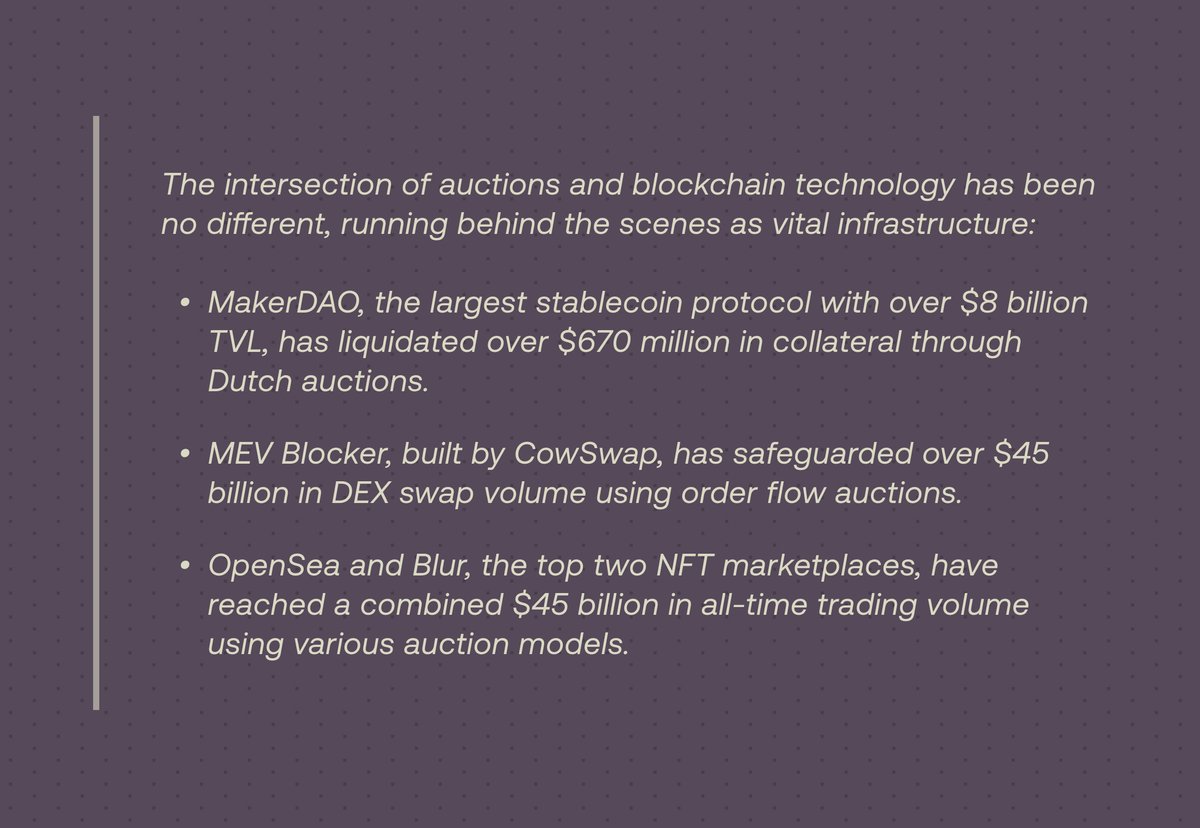

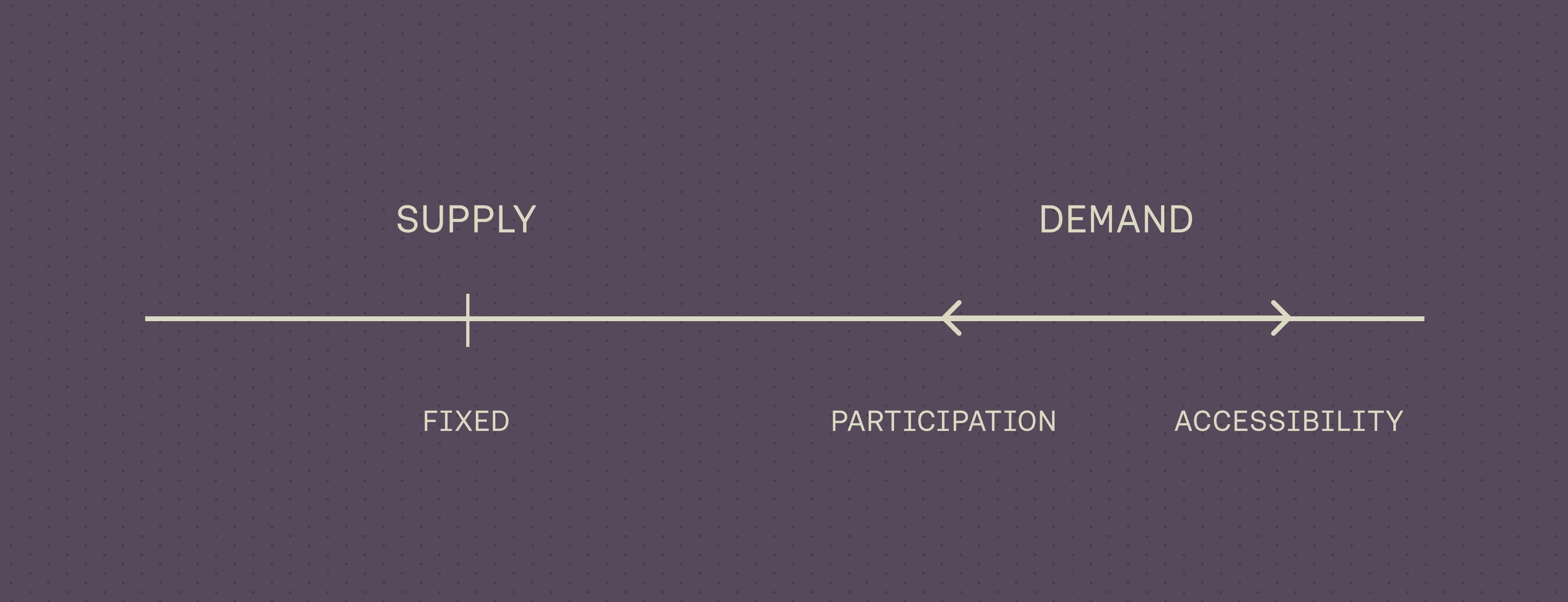

Auctions have been a cornerstone of economic transactions for centuries because they reliably facilitate price discovery for illiquid assets. This holds true in DeFi, where auctions already help secure and manage billions of dollars across various use cases. However, existing token launch strategies, which typically use traditional auctions or mechanisms with auction-like features, operate in open bidding environments that come with significant tradeoffs. These open formats can alter bidder behavior and negatively impact price discovery — arguably the most important outcome.

Some strategies lead to projects launching at predatory valuations, others create PvP dynamics among participants, or both issues occur simultaneously. Consequently, we often see charts turning red post-launch followed by extreme volatility, which is not ideal for both buyers or sellers. To address these issues we built Origin’s flagship product, Sealed-Bid Auctions. This sealed-bid batch auction system excels in accurate price discovery through bidder privacy.

Examining Open Auction Formats

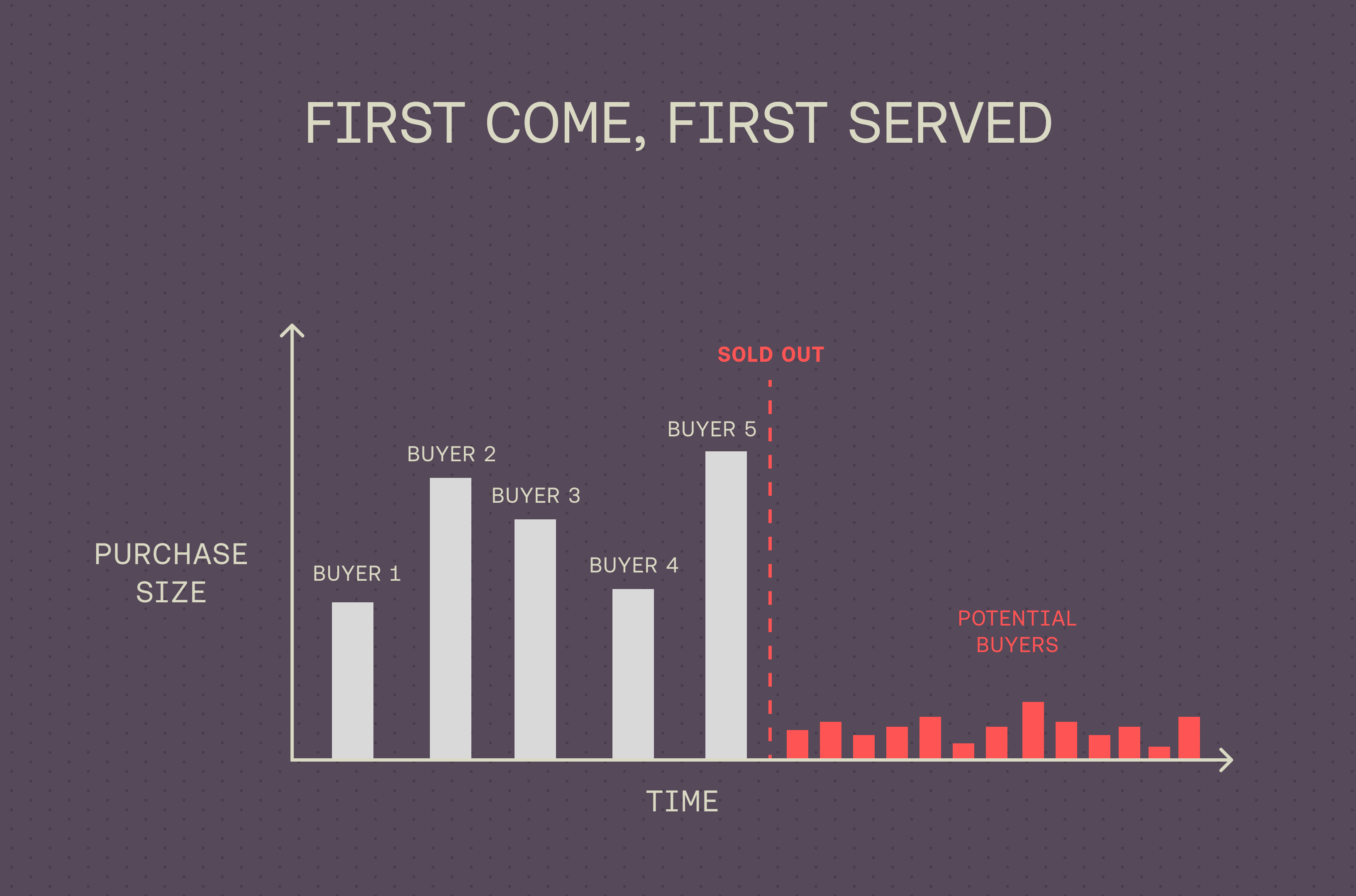

Open auction formats have a tendency to lead to FOMO launches, where the visibility of other participants’ behavior leads to a surge in demand as participants ape in. This was certainly the case for early auction formats on Ethereum such as the notable Gnosis sale. The Dutch auction was designed for tokens to grow less expensive over time, encouraging participants to purchase later in the auction. However, the sale did not go as planned due to a max cap at $12.5m that skewed the bidding incentives. Instead of gradual buying, the auction ended in less than 15 minutes as bidders rushed in and filled the capacity of the auction. This resulted in only 5% of the tokens being sold while still raising 250k ETH.

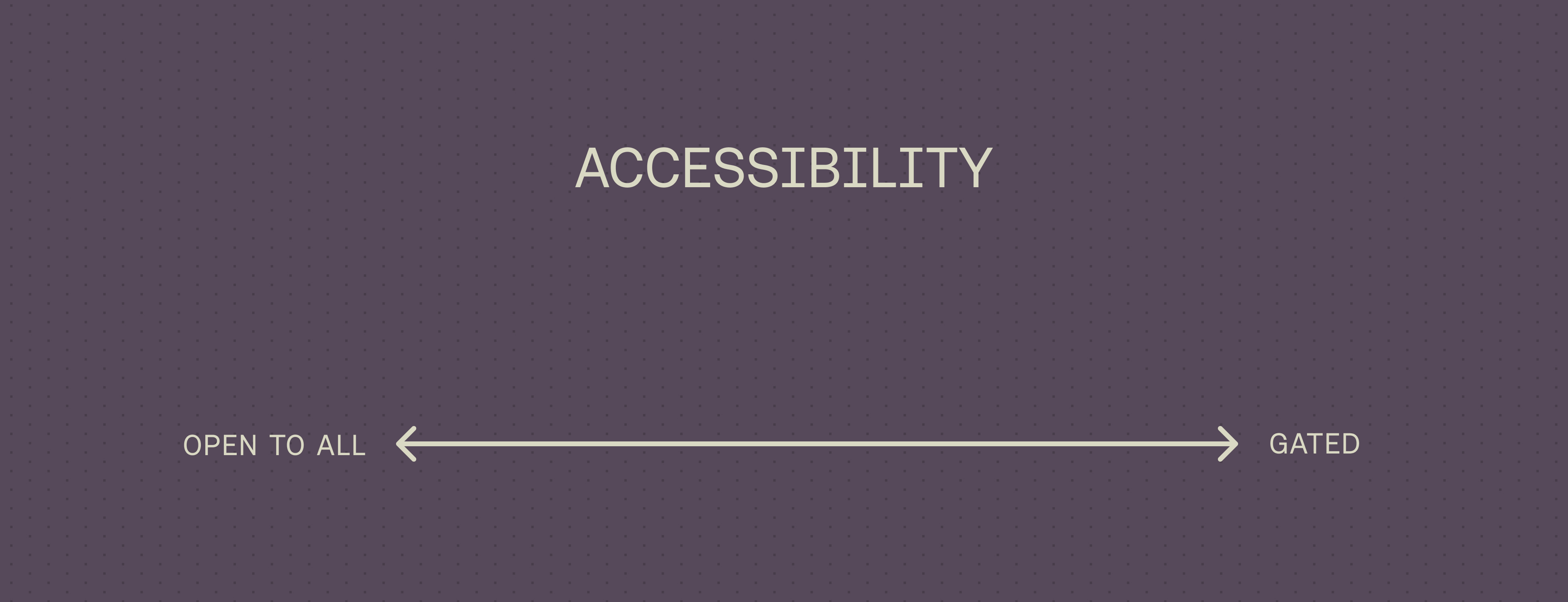

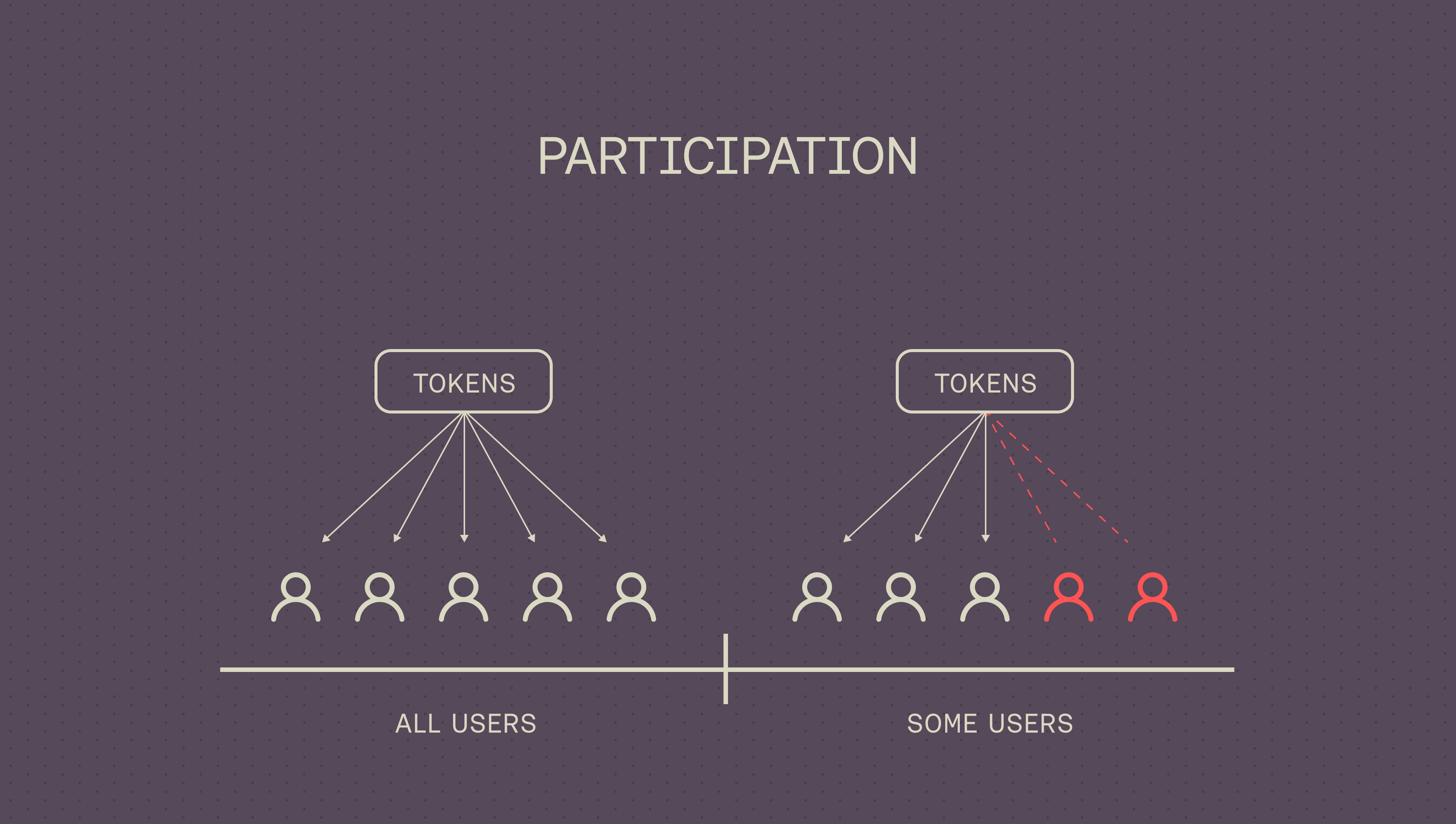

To address the shortcomings of the original $GNO launch, Gnosis introduced a batch auction system where tokens are allocated to bidders starting high to low by price with the clearing price set by the last successful bid. However, the lack of bidder privacy in this system results in inherent PvP dynamics. As bids are visible to all participants, the optimal strategy becomes waiting until the end of the auction to marginally outbid the last successful bid. This gives other participants an unfair advantage, undermining the auction's fairness and preventing true price discovery.

Liquidity Bootstrapping Pools (LBPs) aim to address some of these issues by implementing a dynamic pricing model that adjusts based on supply and demand. Initially, the token price is set high and gradually decreases as the weight of the token in the pool is reduced over time. However, LBPs still face challenges with PvP dynamics due to information asymmetry among participants. More informed participants can time their purchases to exploit price fluctuations, while less informed participants often buy in regardless of the current price to avoid missing out. This behavior leads to tokens launching at predatory valuations as the initial price is driven up excessively.

Sealed-Bid Auctions

For liquid tokens, price discovery naturally occurs due to factors like project track record, previous trading activity, and available liquidity. However, for illiquid assets like newly launched tokens, determining the correct market price is more challenging since these tokens are at the start of their lifecycle. Participants must determine a fair valuation on their own, making it essential for the auction structure and rules to facilitate price discovery by providing an environment where they can place bids at their true valuation.

Sealed-bid auctions offer a robust solution to these challenges as all bids are submitted privately and are not revealed until the auction ends. No peeking, no sniping, no unfair advantages — participants must submit honest bids. Real world use cases help paint the picture:

- 195,000 BTC seized from the Silk Road Marketplace has been sold by the U.S. Marshals Service using sealed-bid auctions.

- The IRS uses sealed-bid auctions to liquidate seized property.

- Government contracts are sold using sealed-bid auctions.

- Real estate and automobiles are often sold using sealed-bid auctions.

- U.S. Treasury Bills are sold using sealed-bid auctions.

Origin's Sealed-Bid Implementation

Origin’s Sealed-Bid Auctions are designed to address the inherent challenges of token launches by leveraging bidder privacy. While we won’t cover technical specs in detail in this post, it’s important to understand its characteristics:

- Multi-unit: Multiple identical items auctioned simultaneously.

- Batch: Bids are grouped together and settled at the end of the auction.

- Encrypted: Participants’ bids are sealed and not visible to others.

- Marginal Price: All winning bids pay the price of the last, marginal bid included.

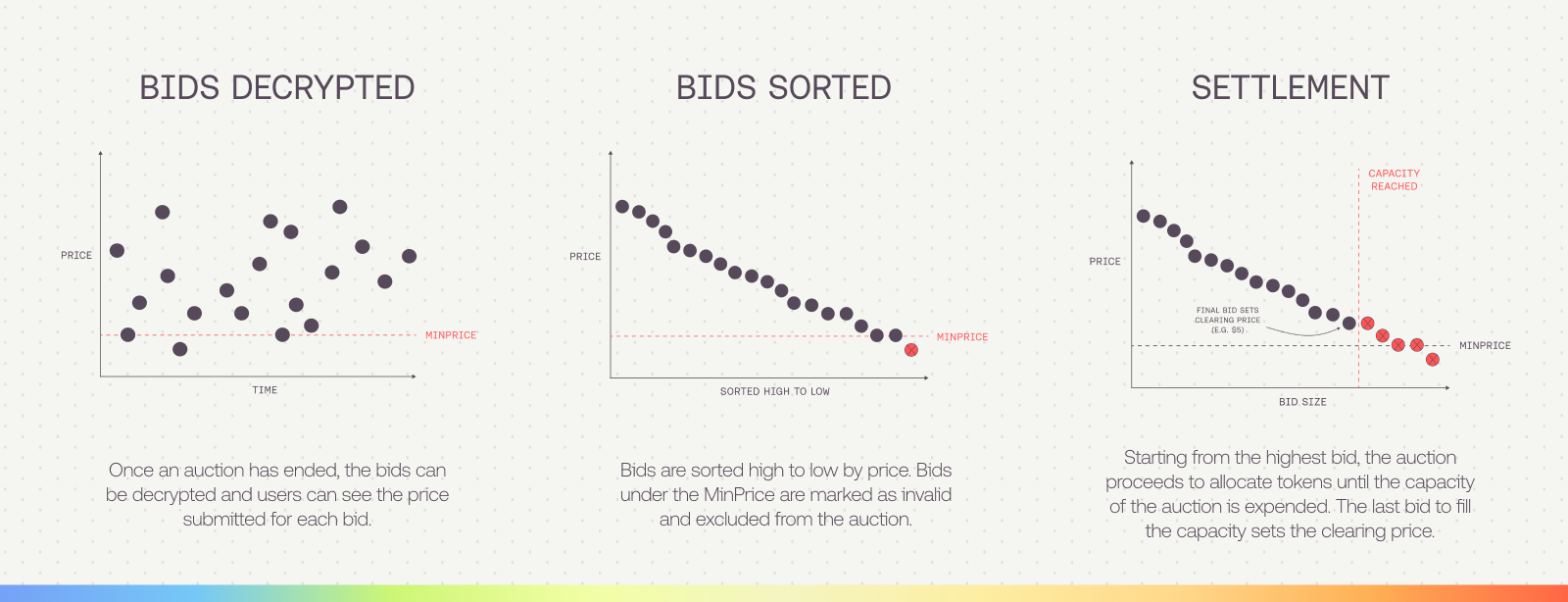

The process begins with participants submitting their bids privately. These bids are encrypted and stored via a hybrid encryption scheme called ECIES until the auction ends. Once the auction ends, bids are decrypted and sorted high to low by price to determine the clearing price. Tokens are allocated starting from the highest bid down until the total capacity is expended, and the last bid to fill the capacity sets the clearing price (i.e. the uniform price that all winning bidders pay). Users that bid above the clearing price will receive more tokens than their initial bid amount, while anyone below this clearing price will not receive tokens and be able to claim a refund.

Closing Thoughts

Sealed-Bid Auctions ensure that participants can submit honest bids based on their true valuations, resulting in price discovery that reflects genuine market demand. As blockchain infrastructure evolves, the possibilities for privacy-preserving auction mechanisms like Sealed-Bid Auctions are endless. If you’re interested in launching on Origin, we invite you to apply here or try out Sealed-Bid Auctions on testnet.