Launchpad is Now Open

We've been quietly building the most decentralized auction dApp in crypto. Today, we're taking the next step in the Open Auction Initiative:

🚀 The Axis Launchpad repo is now fully open-source 🚀

This means that anyone can build, contribute, and extend the functionality of our powerful onchain auction infrastructure.

Evolution of Open Auctions

Axis is built on years of experimentation and learnings from past auction mechanisms. In particular, Gnosis Auction showed the way – using batch auctions for price discovery and helping projects raise over $130M, including projects like CoW Protocol, Silo, TornadoCash, and Bio Protocol.

However, Gnosis Auction faced challenges:

❌ Bid Sniping - users could see live bids and wait until the last moment to slightly outbid others

❌ Gas Costs - activity spiked near the auction close, causing network congestion and high gas fees

❌ Development - as Gnosis shifted focus, the platform lacked development and maintenance

Axis is the spiritual successor to Gnosis Auction – but with major improvements:

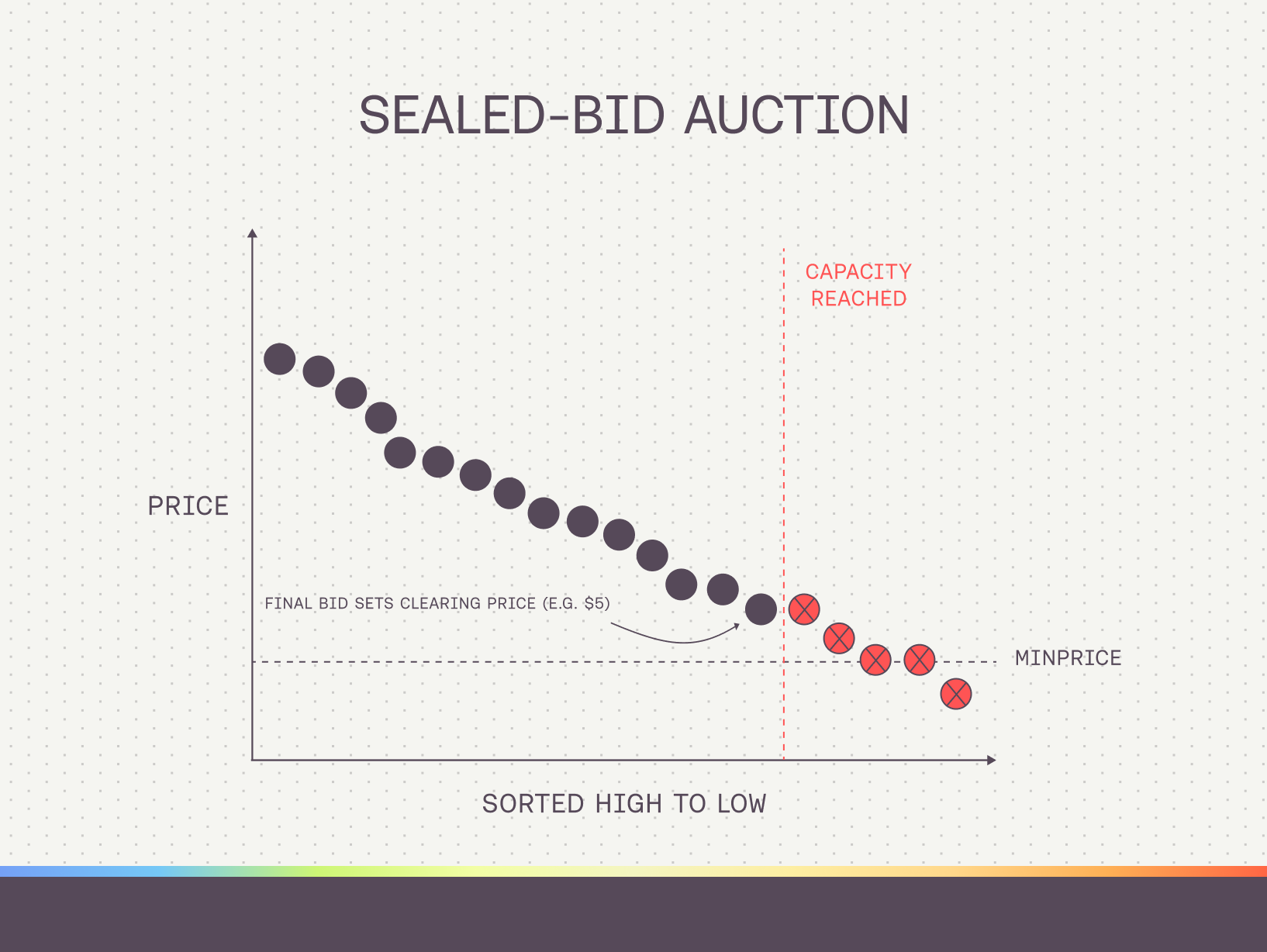

✅ Sealed-Bid - prevent last-minute sniping by keeping bids private until the auction concludes

✅ Modular Approach - auctions can be extended to incorporate allowlists, funding caps, and more

✅ Tech Stack - a modern stack deployed on IPFS and accessible through ENS ensures resilience

What's in a Launchpad?

Axis Launchpad is a feature-rich auction dApp designed to be community-owned and maintained. It supports multiple pricing models – giving projects a fair and transparent way to launch their tokens.

Both fixed-price and sealed-bid ensure sales where every buyer gets the same fair price at the end. This follows best practices from reputable launchpads like CoinList and traditional finance platforms like OpenIPO and TreasuryDirect. At its core, Axis Launchpad isn’t just an auction platform – it’s a framework for trusted, fair token distribution.

But mechanisms are only as good as their use cases. While auctions provide price discovery, buyers also care about the authenticity and credibility of what they’re purchasing.

This is where Curators come in. Traditional auction houses like Sotheby's and Christie's rely on curators to verify and authenticate items before they're sold. A buyer placing a million-dollar bid on a rare painting isn't just betting on its aesthetic value – they need to know it's legitimate and that its value holds up in the market.

Axis curators serve a similar role. They provide trust and transparency in token launches by vetting projects and setting up auction parameters that align with the goals of both buyers and sellers. By enabling curator onboarding in the Launchpad, Axis enables token issuers to work with reputable curators to structure sales that are optimized for distribution, fairness, and long-term sustainability.

Crypto Native Automation – Real Tokens

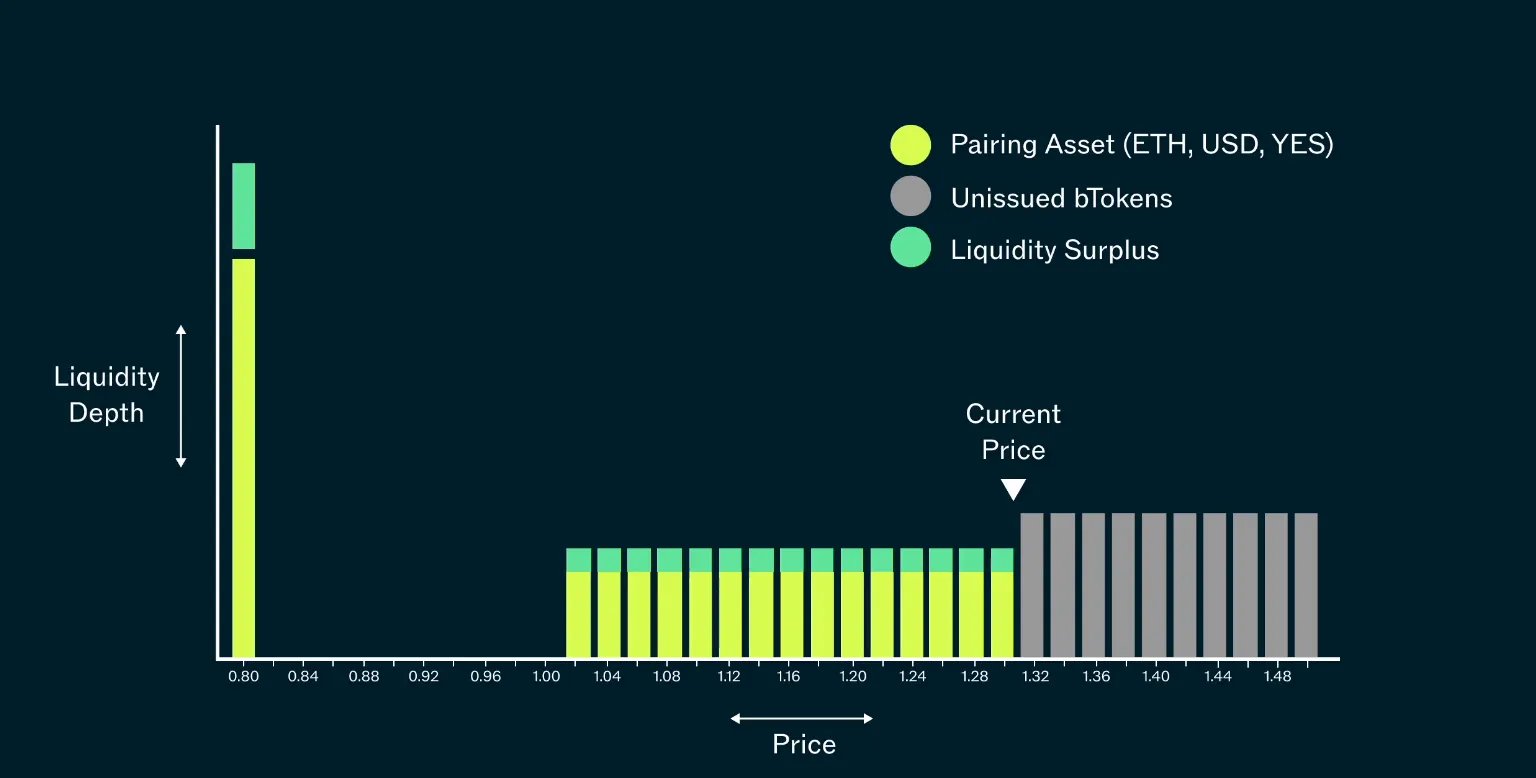

Liquidity is the lifeblood of any crypto asset. Token launches that fail to secure liquidity often result in stalled price action, slippage issues, and fragmented markets. That’s the motivation behind our Direct-to-Liquidity (DTL) framework – an automation system that ensures guaranteed and verifiable liquidity provision using auction proceeds.

This unlocks the same automated dynamics that memecoin traders have grown to love – where tokens immediately are immediately pooled, tradable, and liquid upon launch.

But applied to projects with real utility.

By combining the best of mechanism design, curation, and automated liquidity, Axis Launchpad ensures that every project launching on the platform has the best possible foundation for success.

Get Involved

Now that Axis Launchpad is fully open-source, anyone can contribute, refine, or build on top of the auction experience.

Explore the repo: axis-launchpad

Check out how to contribute: CONTRIBUTING.md

Discuss new features: Axis Discord

This is just the beginning. As we continue to iterate on permissionless token launches, advanced liquidity strategies, and new auction formats, a major milestone is on the horizon.

A new way to participate in Axis is coming soon.

🔗 Follow us for the latest: https://x.com/axis_fi