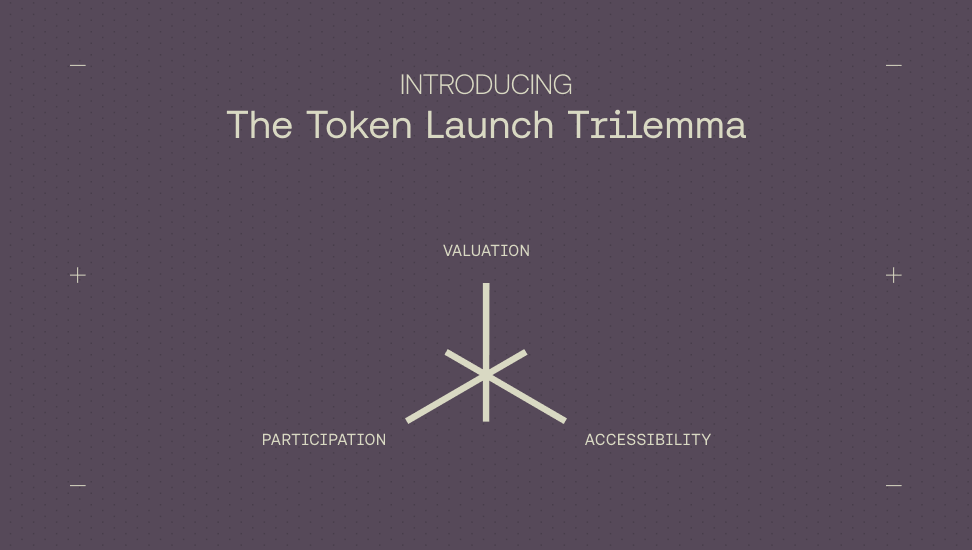

Token Launch Trilemma

Introduction

The Token Launch Trilemma refers to three vital properties that are impossible to maximize for any token launch:

- Accessibility - Ensuring open access for all interested participants

- Participation - Guaranteeing that every participant receives tokens

- Valuation - Establishing a market equilibrium for token price

Trilemmas aren’t new in crypto and have been used to explain important properties of blockchains, stablecoins, and even bridges.

Vitalik described token sale models back in 2017. We expand on his first token sale dilemma by distinguishing between Participation and Accessibility.

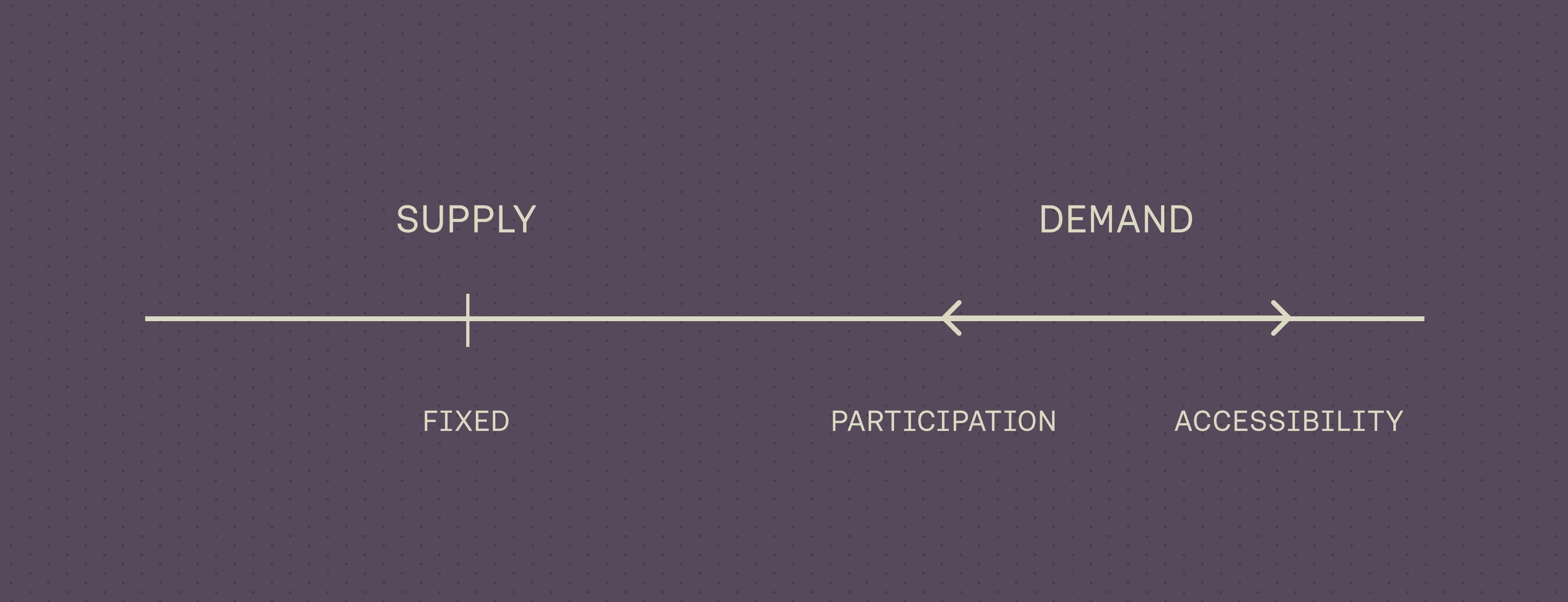

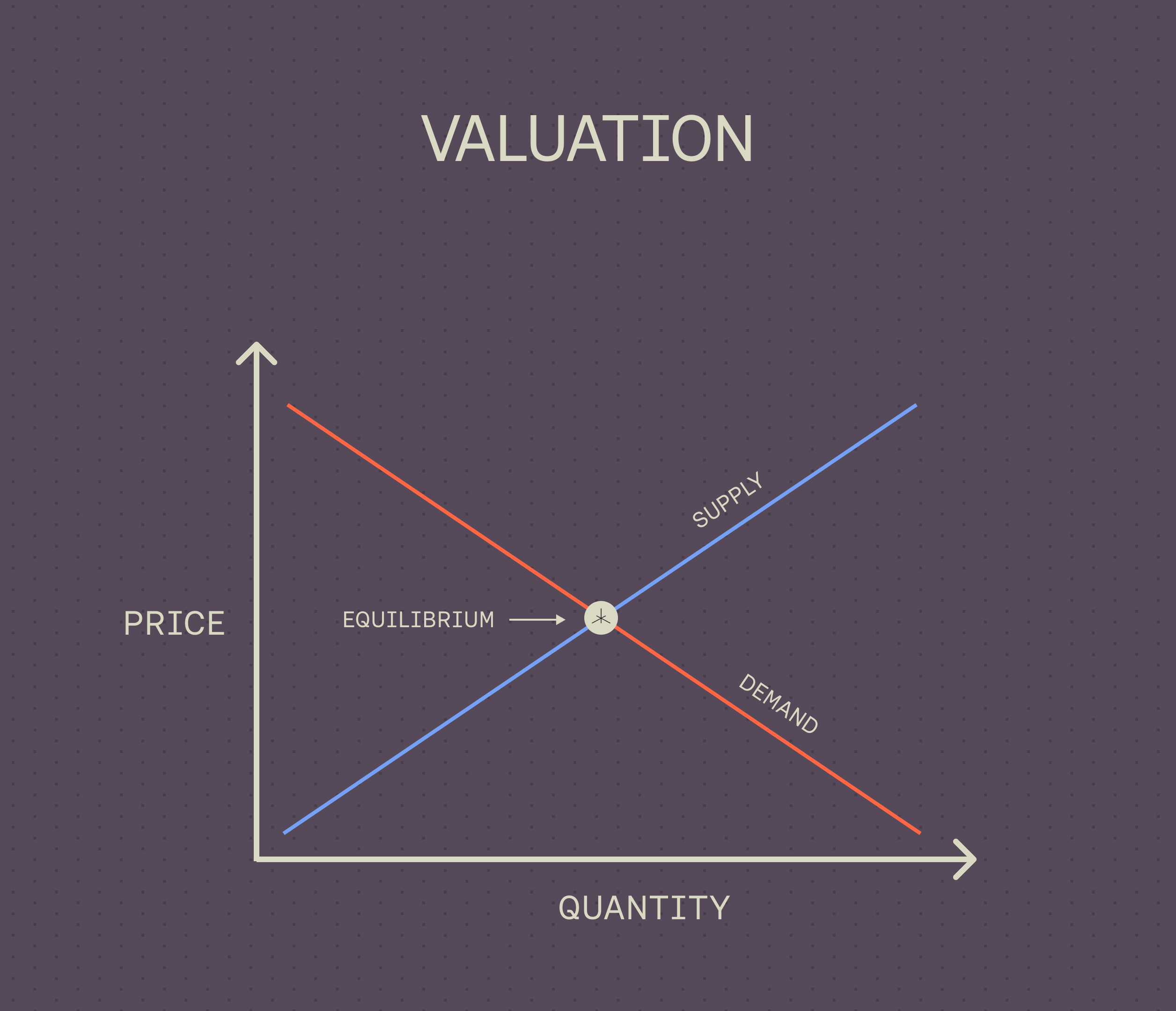

Supply and Demand

When assessing the Token Launch Trilemma, it’s important to keep in mind the basic rules of supply and demand. The initial token distribution is known for most token launches, so the supply side of the equation is fixed. On the demand side, Accessibility and Participation are the driving forces.

Trilemma Pillars

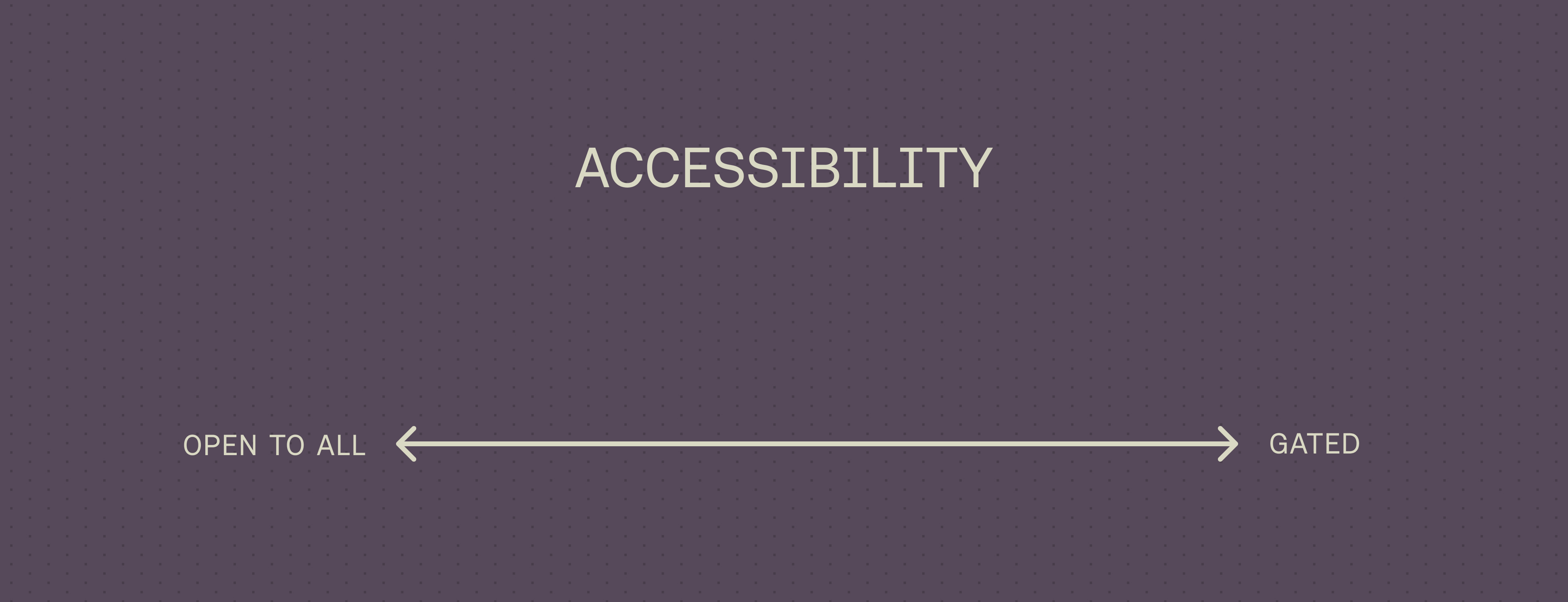

Accessibility is a core feature of any permissionless product in crypto. However, this inclusivity creates difficulty in anticipating demand for a given token launch.

Many launchpads manage this by restricting access to the launch event, either through allowlists or token-gating platforms. This allows them to fix the launch at some pre-determined price and reward a set of selected users.

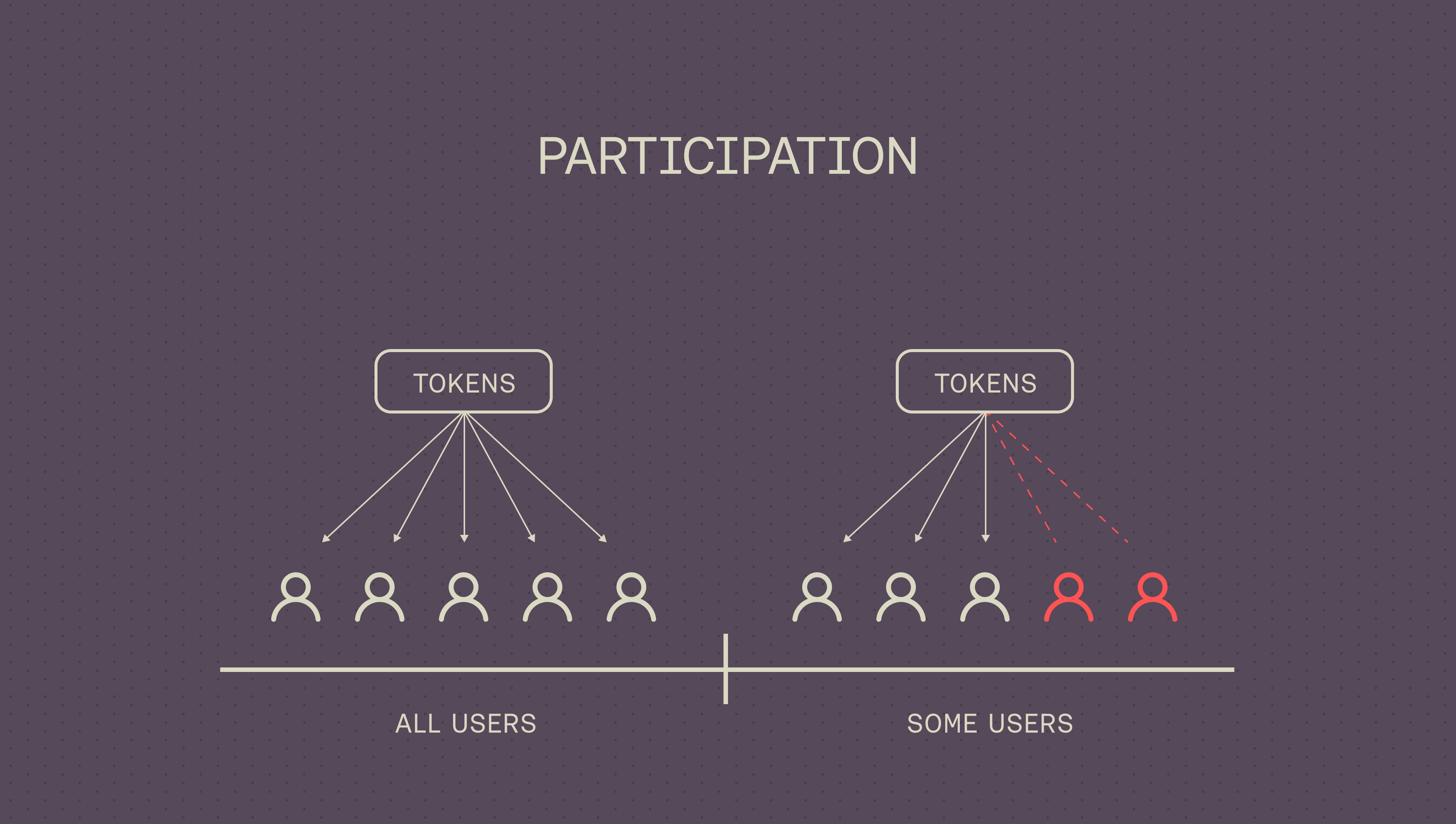

Participation is a property of the launch mechanism that ensures each participant receives tokens according to the rules of the launch.

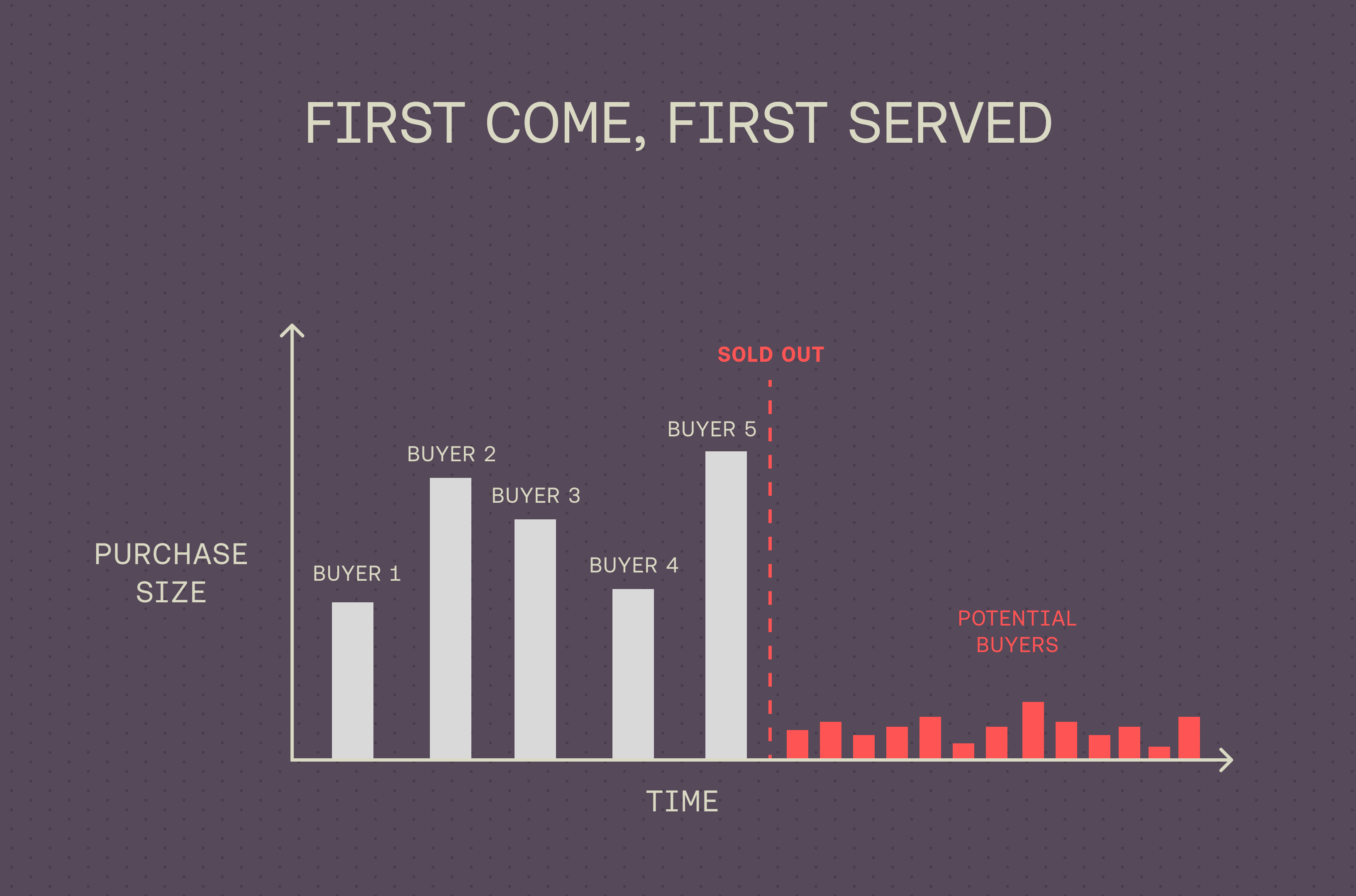

Now, let's use an example to illustrate how Participation can be in tension with Accessibility.

Suppose your token uses a fixed-price sale that is open to all (Accessible) and satisfies bids on a first come, first served basis (Participation). This strategy is susceptible to front-running where a small group captures the full capacity. In fact, this strategy was famously executed during the initial Stargate auction.

Attempting to impose purchase limits per address still leaves the sale susceptible to Sybil attacks. As a result, ensuring that each participant receives tokens according to the rules (first come, first served) actually makes the launch less accessible.

Valuation is the final pillar of the trilemma and is one of the most important outcomes.

With a fixed supply and unknown demand, Valuation is the pillar that suffers the consequences. Although several launch strategies try to optimize for price discovery, existing solutions have notable tradeoffs and flaws that we'll explore in future posts. Some lend themselves to launching at predatory valuations, while others create PvP dynamics between participants.

Closing Thoughts

The Token Launch Trilemma presents a multifaceted challenge for projects aiming to launch their token successfully. We believe finding a balance within the trilemma is the ideal solution, but this hasn't been achieved... Not yet.

At Axis, we’re building auction mechanisms to address these pillars and power the next generation of smart token launches. Leveraging insights from auction theory and industry leaders, we aim to bring battle-tested auction models on-chain and combine them with DeFi money legos.

Stay tuned for our next post where we’ll explain how Axis solves the Token Launch Trilemma. One hint from Vitalik:

Some valuation uncertainty or participation uncertainty is inescapable, though when the choice exists it seems better to try to choose participation uncertainty rather than valuation uncertainty.