Why Direct-to-Liquidity is Essential for Token Launches

Introduction

In an ideal world, every token launch would be led by honest teams and users could trust that their funds would drive development and growth. Unfortunately, reality is different. Each bull market brings a new wave of rug pulls, tarnishing our industry and deterring many retail users. Despite this ongoing issue, few solutions using smart contracts have been widely adopted as a standard.

This is where we step in. Axis is a permissionless infrastructure layer that enables developers to build auction-driven applications. At launch, our native dApp Origin will provide a suite of tools for token launches. One key feature, Direct-to-Liquidity, was designed to directly address this issue.

Origin’s Launch Framework

Before continuing, it’s important to understand the primary token launch mechanisms of Origin.

Fixed-Price Auctions are a straightforward mechanism that allows participants to purchase tokens at a set price on a first-come, first-served basis. This enables projects to acquire initial capital, reward early adopters, and gauge market demand at a predetermined price.

EMP Auctions, Origin’s flagship product, uses a sealed-bid system that allocates tokens to the highest bidders with the clearing price set by the last successful bid to be filled. This enables projects to acquire initial liquidity and discover the market-clearing price.

While projects can use each mechanism independently, they can also be used in stages for a balanced token launch. Fixed-Price Auctions and EMP Auctions serve as Stage One and Two, while Direct-to-Liquidity serves as Stage Three to improve the post-launch dynamics. For more context, read our post on Solving the Token Launch Trilemma.

Understanding Direct-to-Liquidity

Axis offers a variety of callbacks, which are advanced functions that allow additional features based on specific conditions or actions. Direct-to-Liquidity is one such callback used to enhance security and enable price discovery beyond the initial auction phases.

Direct-to-Liquidity automatically seeds a liquidity pool with auction proceeds, a process that is traditionally prone to errors and malicious intent. By automating this process, a layer of programmatic security is added for participants. This feature can be configured at auction creation to deploy liquidity to a DEX, allocate a specific percentage of the auction proceeds, add vesting to liquidity tokens, and more.

One of our core ethos is that deploying an auction should be as easy as deploying a liquidity pool. Vice versa, this is true as well. While specific details are still being finalized, we plan to have ready-to-use, audited Direct-to-Liquidity callbacks for a variety of DEXs to make this process as easy as possible for projects.

The Potential Impact of Direct-to-Liquidity

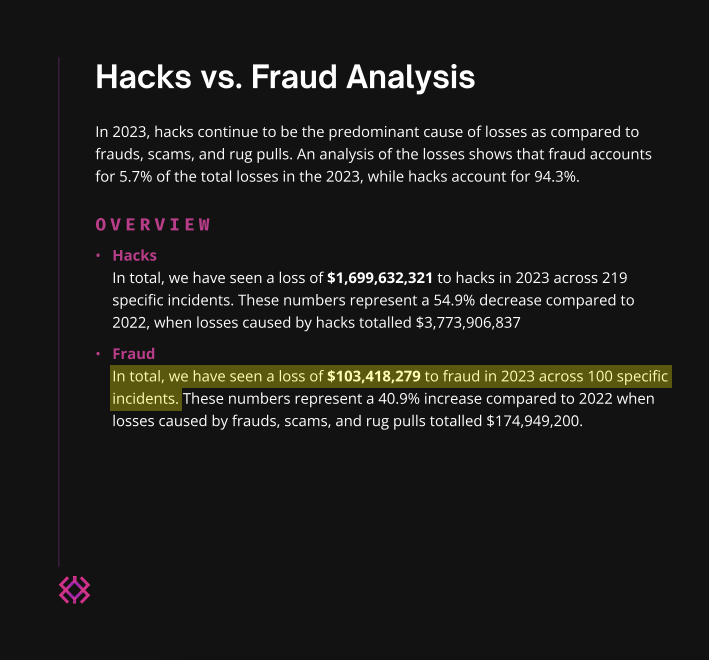

According to ImmuneFi’s Crypto Losses Report, 2023 saw over $103 million in losses due to rug pulls alone, followed by an additional $19 million from the start of 2024 until now. Keep in mind that pre-2023 reports did not distinguish between different types of fraud, while reports from 2023 onward only use rug pull losses for fraud. These figures underscore the persistent vulnerability of users due to inadequate security measures post-launch.

Most, if not all, of these losses could have been prevented with Direct-to-Liquidity. Although implementing this feature is optional, we expect most users to require it for participation. This requirement would allow them to trust the code and guarantee that funds will be utilized transparently and as intended.

Closing Thoughts

Direct-to-Liquidity is a significant advancement in protecting users and maintaining the credibility of on-chain token launches. It allows launch buyers to trust permissionless contracts to direct the proceeds of the launch instead of trusting teams to execute directly.

If you’re a project interested in leveraging the benefits of Direct-to-Liquidity, consider launching on Origin. Reach out to us to learn more about how you can integrate this powerful feature into your token launch strategy.