Axis Newsletter — May 2024

Welcome to the first edition of our monthly newsletter, where we'll be sharing recurring updates on Axis, the fundraising landscape, and other relevant topics.

If you want to stay up-to-date in the meantime, make sure to follow us on Twitter and join the community!

To receive this newsletter in your inbox, sign up here.

In May, we focused on tasks that are critical for our upcoming launch.

The completion of our Sherlock Audit Contest in late April enabled us to prioritize launching V2 of the Origin Testnet dApp. This version features updated contracts, audit fixes, and other improvements for users. We also opened public access to our Discord and Testnet. If you're interested in participating, checked the pinned announcements in our Discord for the testnet guide.

We launched a new landing page with updated information about the protocol's auction and derivative modules, features like callbacks and allowlists, and ways for users to contribute. This also includes our self-hosted blog and documentation.

Our current priorities are finalizing the production designs and upgrades for the Origin dApp, reviewing our new implementation for Fixed-Price Auctions, and onboarding curators and launch partners.

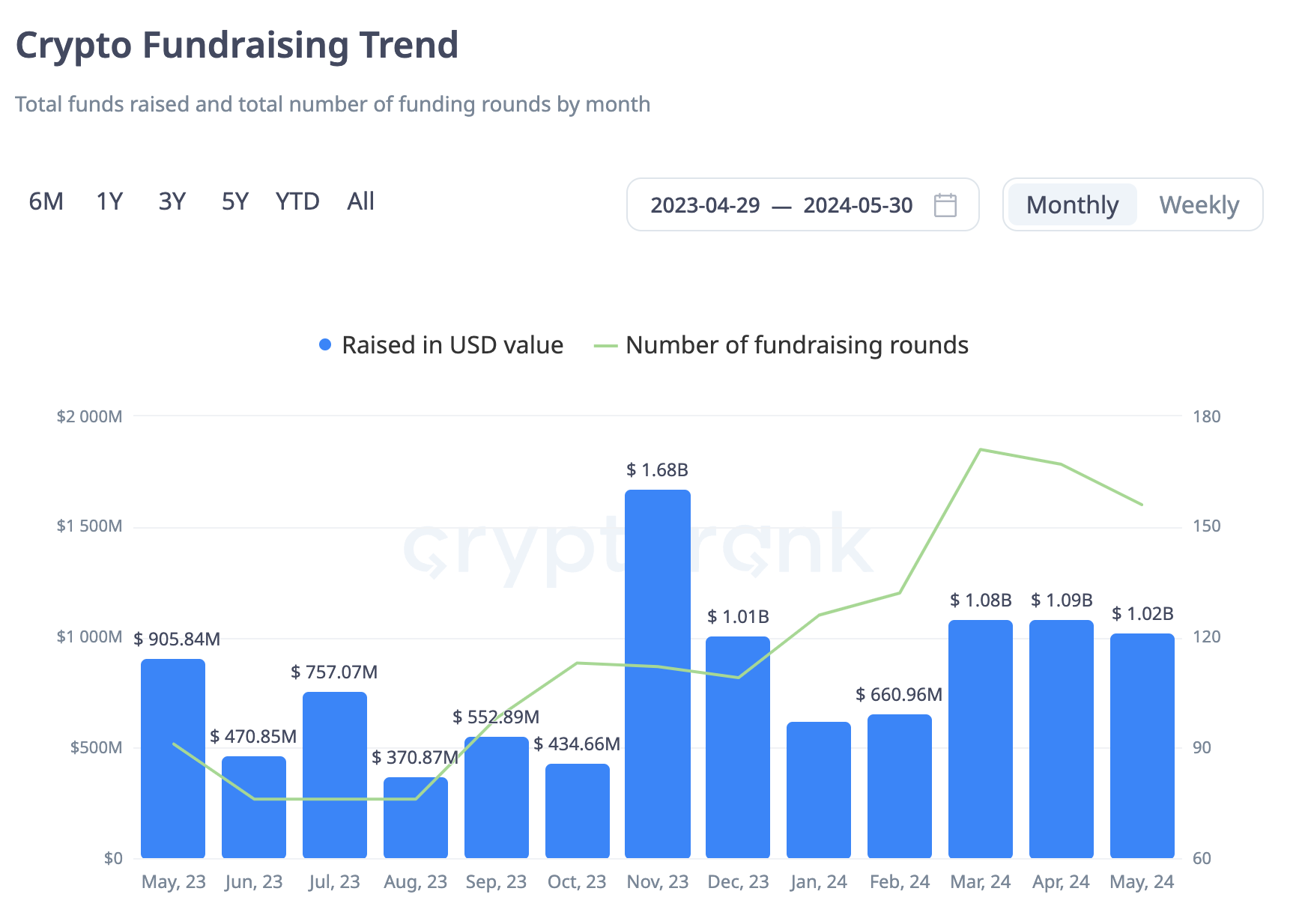

The fundraising landscape in May remained consistent with the last six months. Over $1B was raised across 156 rounds — a good indicator that no steam has been lost and investor interest remains strong heading into Q3 2024. The chart below via CryptoRank shows fundraising statistics from May 2023 to May 2024.

The most notable fundraises across crypto in the past month were:

- Farcaster: $150M | Social Network Protocol | Series A | Led by Paradigm

- Babylon: $70M | Bitcoin Staking | Undisclosed | Led by Paradigm

- Securitize: $47M | Real-World-Assets | Strategic | Led by BlackRock

- Sophon: $60M | Ethereum Layer 2 | Node Sale

- Polymarket: $45M | | Prediction Market | Series B | Led by Founders Fund + participation from Vitalik

- Humanity Protocol: $30M | Web3/Digital Identity | Seed | Led by Kingsway Capital

- Arbelos Markets: $28M | Trading Firm | Led by DragonFly Capital

Since this is our first newsletter edition, this section also includes all content released prior to May to catch you up:

- 2/27/24: Our first post was a thread introducing Axis, the history of auctions, and our native dApp Origin.

- 3/1/24: Oighty published a blog covering the complexities of on-chain auctions, the importance of bidder privacy, and our exploration of different sealed-bid implementations

- 3/20/24: I posted a thread highlighting the revenue opportunity for Referrers and Curators.

- 3/27/24: I posted an infographic that illustrates how EMP Auction are settled.

- 4/4/24: Tex and I published Introducing the Token Launch Trilemma, which explains the three pillars that are impossible to maximize for any token launch. Read the blog here or the thread here.

- 4/17/24: Tex and I published Solving the Token Launch Trilemma, which explores the shortcomings of legacy launchpads and how Origin's multi-stage launch sequence tackles these issues. Read the blog here or the thread here.

- 4/18/24: Tex dives into how insights from previous token launch mechanisms and Vitalik inspired Axis in this thread.

- 4/24/24: I posted a thread highlighting how each feature of Origin can shape a token launch.

- 4/24/24: I posted an infographic covering the three stages to a balanced token launch using Origin.

- 4/30/24: Our frens at Baseline hinted at our upcoming integration.

- 4/30/24: I posted a thread with more in-depth info about becoming a Curator.

- 5/14/24: I posted a promo video of the new Axis landing page.

- 5/23/24: Tex published The Mechanics of EMP Auctions, which covers the full life cycle of our flagship token launch mechanism, from creation and configuration to bid encryption and settlement process.

- 5/31/24: I published Why Direct-to-Liquidity is Essential, which highlights how this key feature could've prevented over $120M in losses from rug pulls.