How EMP Auctions Work

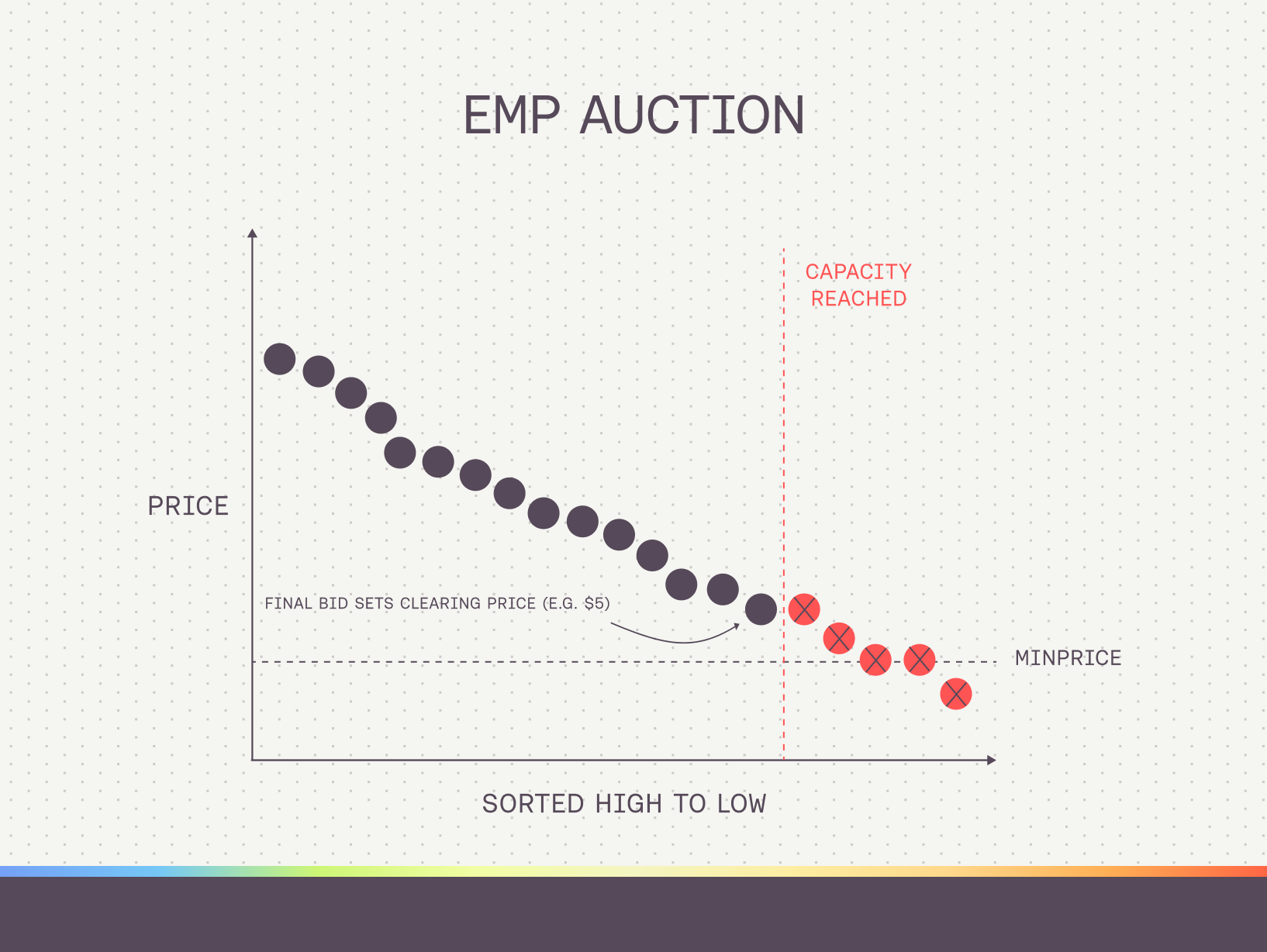

EMP Auctions are a sealed-bid system that allocates tokens to the highest bidders, with the clearing price set by the last successful bid to be filled. For example:

- A project creates an EMP Auction for their token launch with a capacity of X amount of tokens.

- Users start bidding on the auction for a X amount of tokens at the price they are willing to pay.

- Once the auction ends, the settlement phase begins where the system will need to decrypt and sort the bids to find a clearing price.

- Next, tokens are allocated to bidders starting from high to low by price until there are no more tokens left.

- The final bid to receive tokens will set the clearing price, which is the uniform price that all winning bidders will pay.

- Users that bid above the clearing price will receive more tokens than their initial bid amount, while anyone below this clearing price will not receive tokens and be able to claim a refund.

Why Participate in EMP Auctions?

Superior price discovery is one of the main advantages of EMP Auctions. Since bids are private and encrypted, participants can bid their true price for the token without fear of being sniped before the auction ends. If their bid wins, they acquire tokens at the most fair price possible due to the auction's settlement process.

EMP Auctions also remove the influence of timing on token launch results. In traditional LBP token launches, there's often a competitive scramble where getting in at the right time is critical to secure the best price. In contrast, EMP Auctions ensure that all winning bids placed before the auction closes are cleared at a uniform price.

How can Losing Bidders Participate?

If a Direct-to-Liquidity Callback is implemented, the payout token will be available for trading immediately after the auction settles. Users can then navigate to the liquidity pool and purchase the token at a price similar to the clearing price — ideally as soon as possible.