June 2024

Welcome to the second edition of our monthly newsletter, where we'll be sharing recurring updates on Axis, the fundraising landscape, and other relevant topics.

If you want to stay up-to-date in the meantime, make sure to follow us on Twitter and join the community!

To receive this newsletter in your inbox, sign up here.

Continuing from our May 2024 newsletter, our priority remains on completing tasks to bring us closer to our official launch.

For those unaware, we've been rolling out different versions of the Origin Testnet: V1 with our MVP interface, V2 with upgraded features, and most recently V3.

This latest update includes significant upgrades and will be the final version of the Origin dApp before its official launch. Here's what you can expect:

- Revamped UI Designs: A complete overhaul from Testnet V1 and V2 designs

- New Fixed-Price Batch Auction contracts: Improves UX for buyers and configurability for sellers

- Referral Link Generation: Generate referral links for specific launches

- Enhanced Token Launch Info: Includes details like Target Raise, Minimum Raise, and Fixed-Price/Minimum Price FDV to better inform users during bidding

- Improved Settlement Charts: Get better insights on your bids after a token launch ends

- My Launches Tab: View all of your created token launches in one place

- Token Launch Preview: See a preview of your token launch and review its configuration before deployment

- Callbacks at Auction Creation: Add customizations like allowlists or Direct-to-Liquidity to your token launch

In addition to these changes, we are developing even more features that we aim to have ready for launch. Onboarding curators and launch partners also remains a focus, and we're excited to share those updates when the time comes! Anyone is welcome to apply here.

In the meantime, please try out Testnet V3 and leave any feedback in the General or New Ideas channels in our Discord.

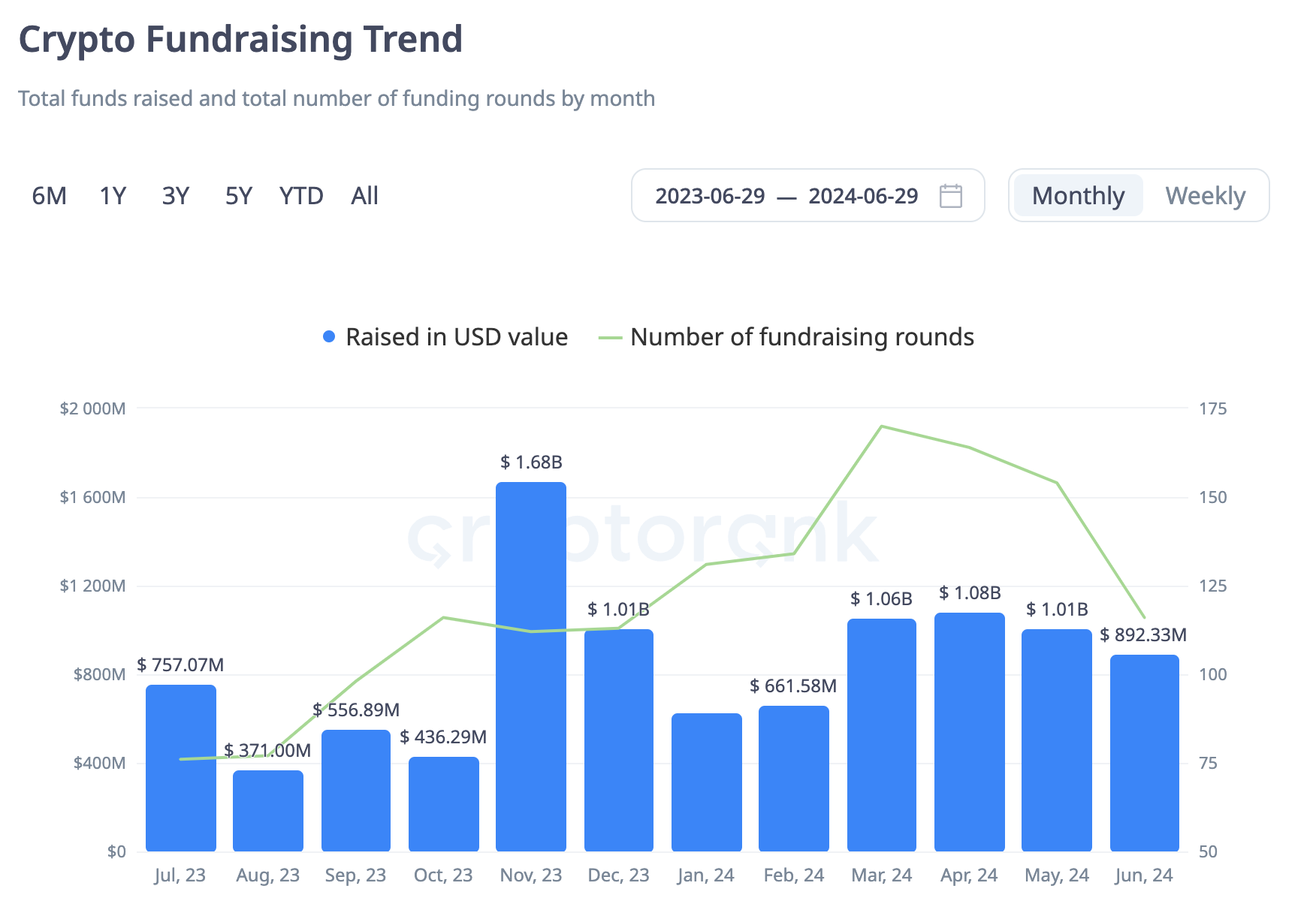

The fundraising landscape in June showed a decrease in investor activity with only 116 rounds, the lowest of all months in 2024. However, the total amount raised was $892M — still a large figure when considering previous bear market fundraises and the current market volatility.

The most notable fundraises across crypto in June were:

- Hut 8 Mining: $150M | Bitcoin Mining | Strategic | Funded by Coatue Management

- Avail: $43M | Modular Blockchain Infrastructure | Series A | Led by DragonFly Capital

- Conduit: $37M | Rollups-as-a-Service | Series A | Led by Paradigm

- M^0: $35M | Institutional Stablecoin Issuance | Series A | Led by Bain Capital

- Nexus Laboratories: $25M | Zero-Knowledge Infrastructure | Series A | Led by Pantera Capital

- MegaETH: $20M | Real-time Ethereum | Seed | Led by DragonFly Capital + participation from Vitalik, Joseph Lubin, and more

- ORA: $20M | AI Oracles | Series A | Participation from Polychain Capital and HashKey Capital

Content releases slowed down in June as we gear up for launch. Nonetheless, there are a few posts worth highlighting:

- 6/11/24: We published The Importance of Bidder Privacy in Token Launches, which explains how our privacy-preserving mechanism, Sealed-Bid Auctions, makes drastic improvements over open auction formats that negatively impact bidder behavior and price discovery.

- 6/19/24: We posted a tweet inviting Curators, linking to our one-pager that highlights important details like their potential revenue, responsibilities, and more.

- 6/27/24: We posted a tweet covering the insightful analysis on LBPs by Hyphin. Key takeaways are that LBPs often result in Inflated valuations and post-launch volatility, which poses challenges for token launch participants. Read the full article here.