August 2024

Welcome to the third edition of our monthly newsletter, where we'll be sharing recurring updates on Axis, the fundraising landscape, and other relevant topics.

If you want to stay up-to-date in the meantime, make sure to follow us on Twitter and join the community!

To receive this newsletter in your inbox, sign up here.

On August 6th, Axis became DeFi's first modular auction protocol and went live on Arbitrum, Base, Blast, Mantle, and Mode.

Our production dApp, Origin, also went live with the following features for token launches: Sealed-Bid Auctions, Fixed-Price Sales, Vesting, Direct-to-Liquidity and Allowlists.

It's been an exciting journey since the start of 2024. After many development and feedback cycles, we're much closer to achieving our goals of:

- Creating a Modular Infrastructure Layer for Auction Development and Deployment: Axis is the first permissionless platform for developers to build auction-driven applications by combining various modules. Auctions are the backbone of many critical use cases in crypto, and we believe there’s potential to push these boundaries even further.

- Showcasing Auction-Driven Mechanisms: We’ve brought sealed-bid auctions on-chain to optimize for price discovery, addressing a recurring pain point in our industry.

We also onboarded our first Curator in Revelo Intel, who has been a leading crypto research platform since 2022, and our first launch partner in Aurelius Finance, a protocol on Mantle that combines mechanisms from Liquity and Aave to offer interest-free loans with an integrated lending market.

At time of writing, their auction remains live with $39.5k in wMNT bids, which is well past their minimum raise target of $9.4k. To view the auction, you can navigate to the Origin dApp here.

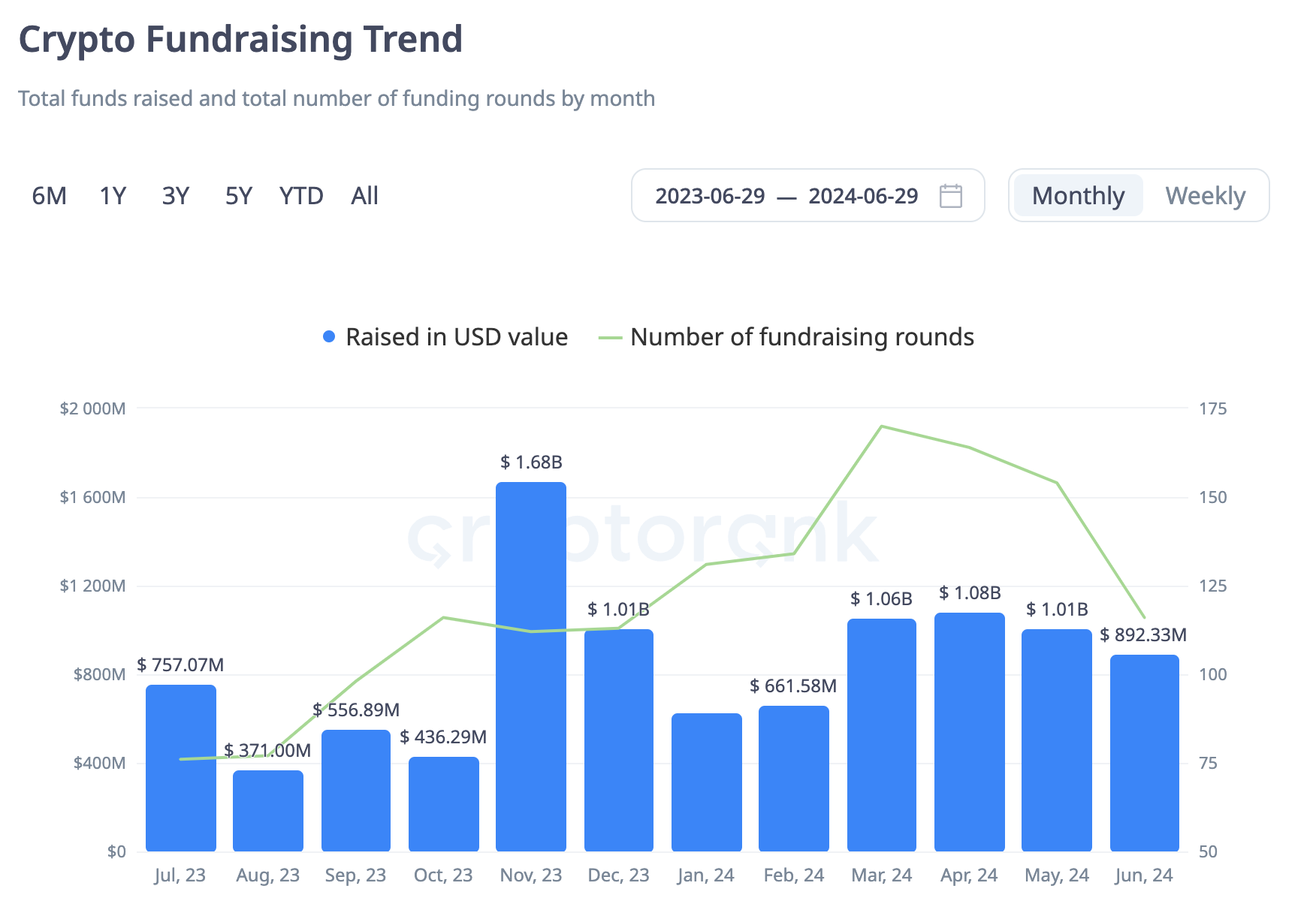

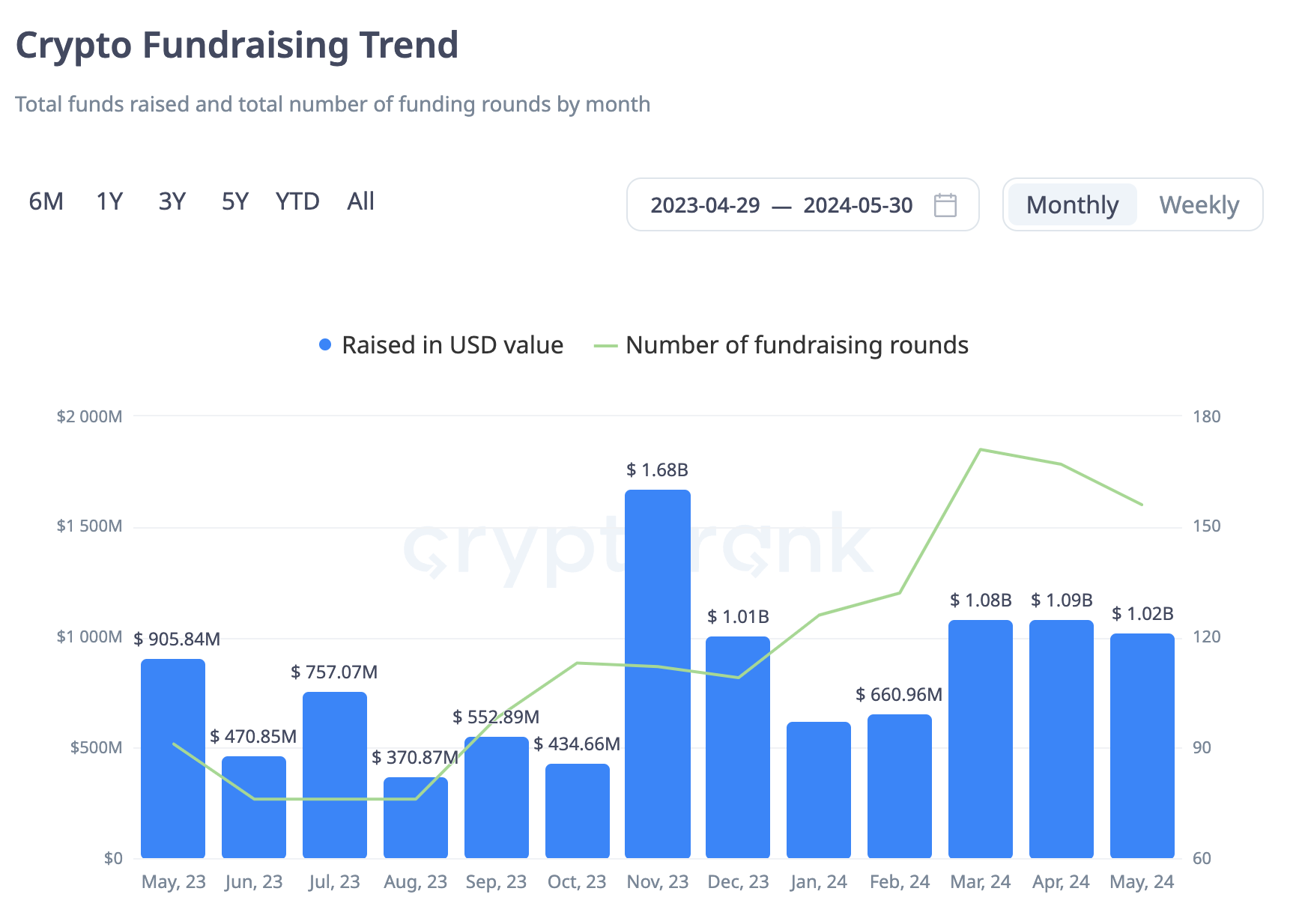

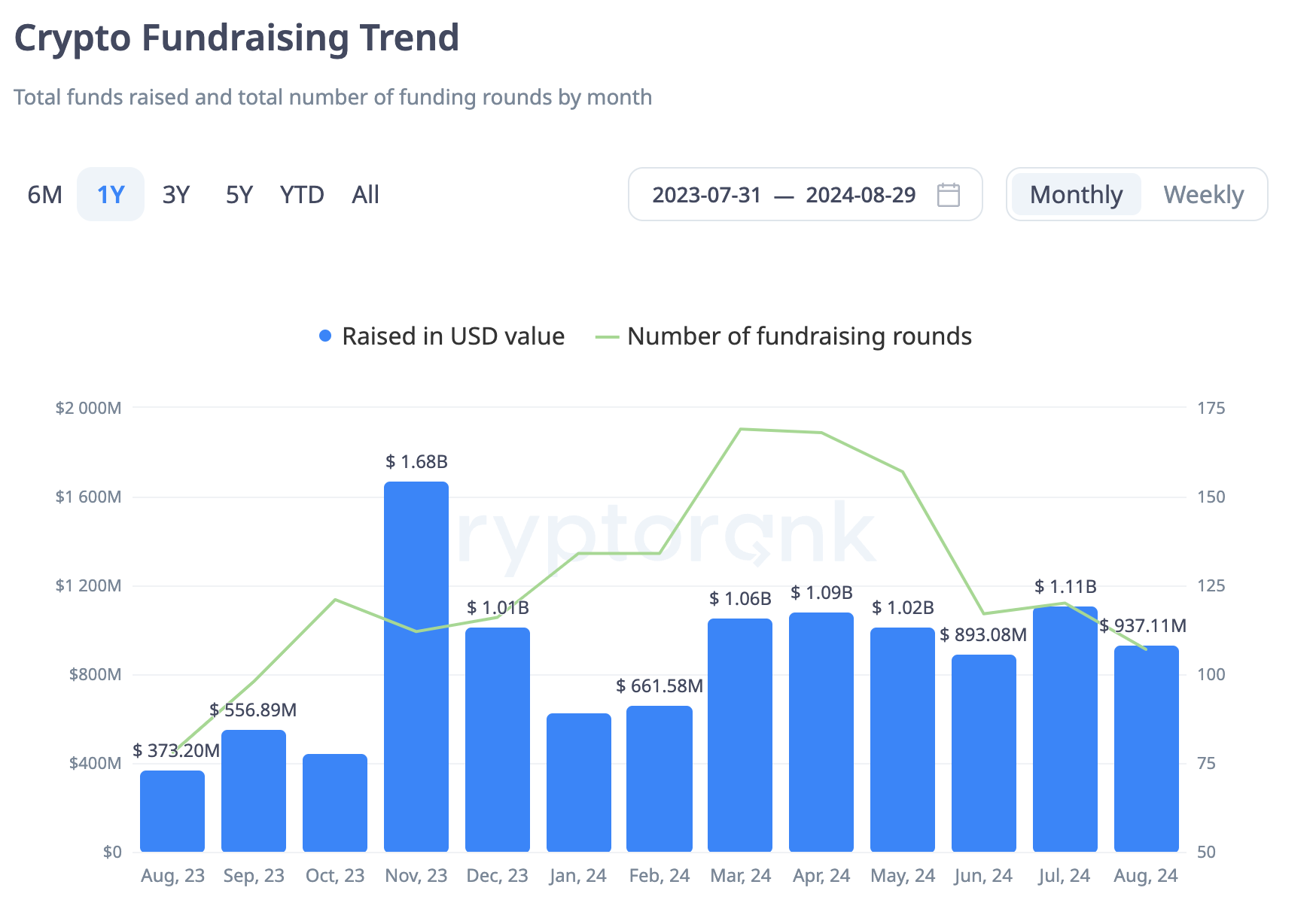

Over the past six months, the total funds raised each month have consistently hovered around $1 billion. Meanwhile, the number of monthly funding rounds has gradually declined from ~160 to just over 100.

Although these statistics have remained relatively stable, it remains to be seen whether the total amount raised will eventually mirror the declining trend in funding rounds — especially considering the current market conditions. It's no secret that now is not an ideal time to raise.

The most notable fundraises across crypto in August were:

- Story Protocol: $80M | IP-Focused Blockchain | Series B | Led by a16z and Polychain Capital

- Bridge: $58M | Stablecoin Payment Network | Undisclosed | Led by Sequoia and Ribbit Capital

- Chaos Labs: $37M | On-chain Risk Management | Series A | Led by Haun Ventures

- Morpho: $50M | Lending Protocol | Strategic | Led by Ribbit Capital

- Sahara AI: $43M | AI Blockchain | Series A | Led by Binance Labs, Pantera Capital, and Polychain Capital

- Fabric: $33M | Cryptography Hardware | Series A | Led by Blockchain Capital and 1kx

- WSPN: $30M | Stablecoin Payment Network | Seed | Led by Foresight Ventures and Folius Ventures

- 7/31/24: To introduce Revelo Intel, we published a Meet the Curator. We plan to continue this series for future Curators, so you can quickly learn about their value-add to the Axis ecosystem.

- 8/1/24: We also hosted an AMA with Revelo, which you can find the full recording of here or read the recap here.

- 8/6/24: Our official launch posts were published, which covers everything from features of Axis and Origin, protocol fees, and how to get started. Read the full article here and the thread here.

- 8/8/24: We partnered with Sherlock to offer a unique 50,000 USDC reward through their new bug bounty program. Learn more here and here.

- 8/8/24: Ahead of their token launch, Aurelius published a myriad of educational resources. This included tips for bidding, how users set the price in sealed-bid auctions, and how users can place multiple bids.

- 8/9/24: We published a thread on the Axis Referral Program and how users can participate.

- 8/12/24: Revelo Intel published a full project analysis on Aurelius. This is featured on the auction in our dApp, but you can find it here as well.

- 8/14/24: Eli5 published an infographic covering key metrics of Aurelius and how it stacks up against similar protocols.

- 8/19/24: We published a blog post outlining how vesting tokens work on Axis, when sellers should implement them, and best practices.

- 8/27/24: We joined an episode of Mantle Ecowaves alongside Aurelius to discuss their V2 auction.