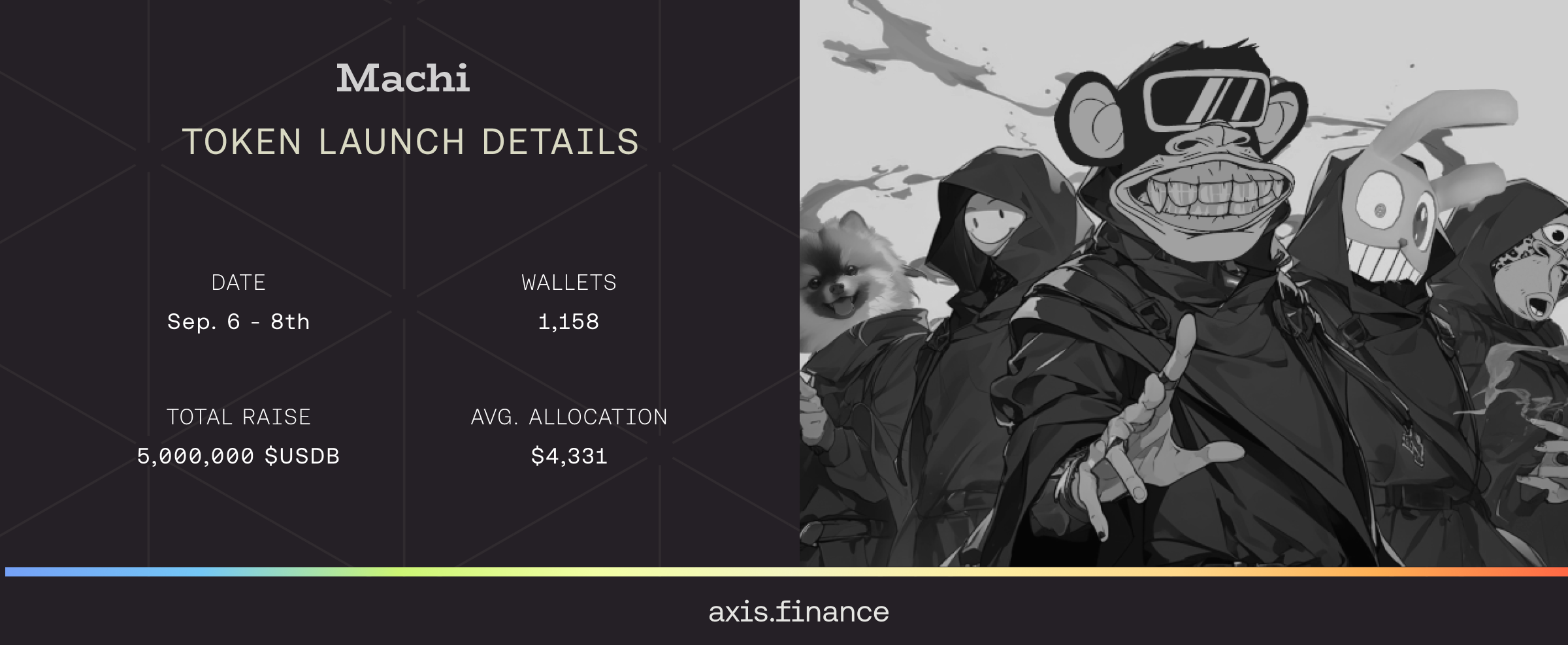

Machi Token Launch

We’re proud to announce the completion of the $MACHI token launch, a successful collaboration that combined Axis’ advanced auction infrastructure with Baseline’s automated tokenomics system. The total raise amount was $5 million, spread across 1,158 wallets with an average allocation of $4,331.

The Role of Axis

Axis is a modular auction protocol that enables developers to easily build, combine, and deploy a range of auction mechanisms. Our flagship product is the first on-chain sealed-bid auction system, designed to optimize for price discovery in token launches. In this case study, our Fixed-Price Sale contracts were used alongside other tools from the Axis product suite.

The $MACHI token launch was conducted in two phases: the Community Round and the Public Round. Each phase utilized a Merkle tree whitelist to ensure that eligible participants had specific bidding caps, all made possible through Axis’ advanced callback system.

Throughout the event, $5 million in USDB bids were securely managed via our Fixed-Price Sale contracts. Upon settlement, 80% of the auction proceeds were automatically deployed into pre-configured liquidity pool ranges using a custom Direct-to-Liquidity callback, built specifically for Baseline markets.

Finally, $MACHI tokens were distributed directly to participants in bulk. No off-chain processes or manual oversight were required. Every step was executed exactly as described, removing any extra trust assumptions from users.

Baseline’s Role

Baseline is a DeFi protocol that redefines tokenomics through programmable assets known as bTokens. These tokens come with built-in protections and dynamic liquidity management to ensure price stability and long-term growth.

The key to Baseline's system is the Baseline Value (BLV), which is the guaranteed minimum price. Every time a bToken is traded, a portion of liquidity is autonomously reserved to back the BLV. This gives token holders a safety net, minimizing their downside risk while keeping upside potential open. As trading continues, the BLV gradually rises, creating a floor price that appreciates over time and rewards holders. The more trading activity there is, the more liquidity accumulates, which in turn strengthens the BLV.

bTokens also have other features like market-driven token issuance, loans and loops, and an automated buyback mechanism known as the Afterburner, which continuously supports the token’s market premium above the BLV. The Afterburner uses surplus liquidity generated from Baseline’s protocol operations, such as trading fees, to fund periodic buybacks. The system operates at all times, with buyback attempts occurring every 10-15 minutes.

Closing Thoughts

We’re ecstatic to have the $MACHI token launch as a strong proof point for our auction infrastructure in combination with cutting-edge protocols like Baseline. With $5 million raised, the entire process from whitelisting to liquidity deployment was executed seamlessly. As we continue to refine and expand our platform, we look forward to powering more projects like MACHI that are pushing the boundaries of tokenomics and capital formation.

Now that Machi’s Baseline market is live, we're excited to see the full impact of their system during the price discovery phase. Their approach to liquidity management and automated tokenomics is set to be a game changer.

For projects looking to take part in next-generation token launches, Axis provides the tools to make it happen. Get in touch here.