How Fixed-Price Sales Work

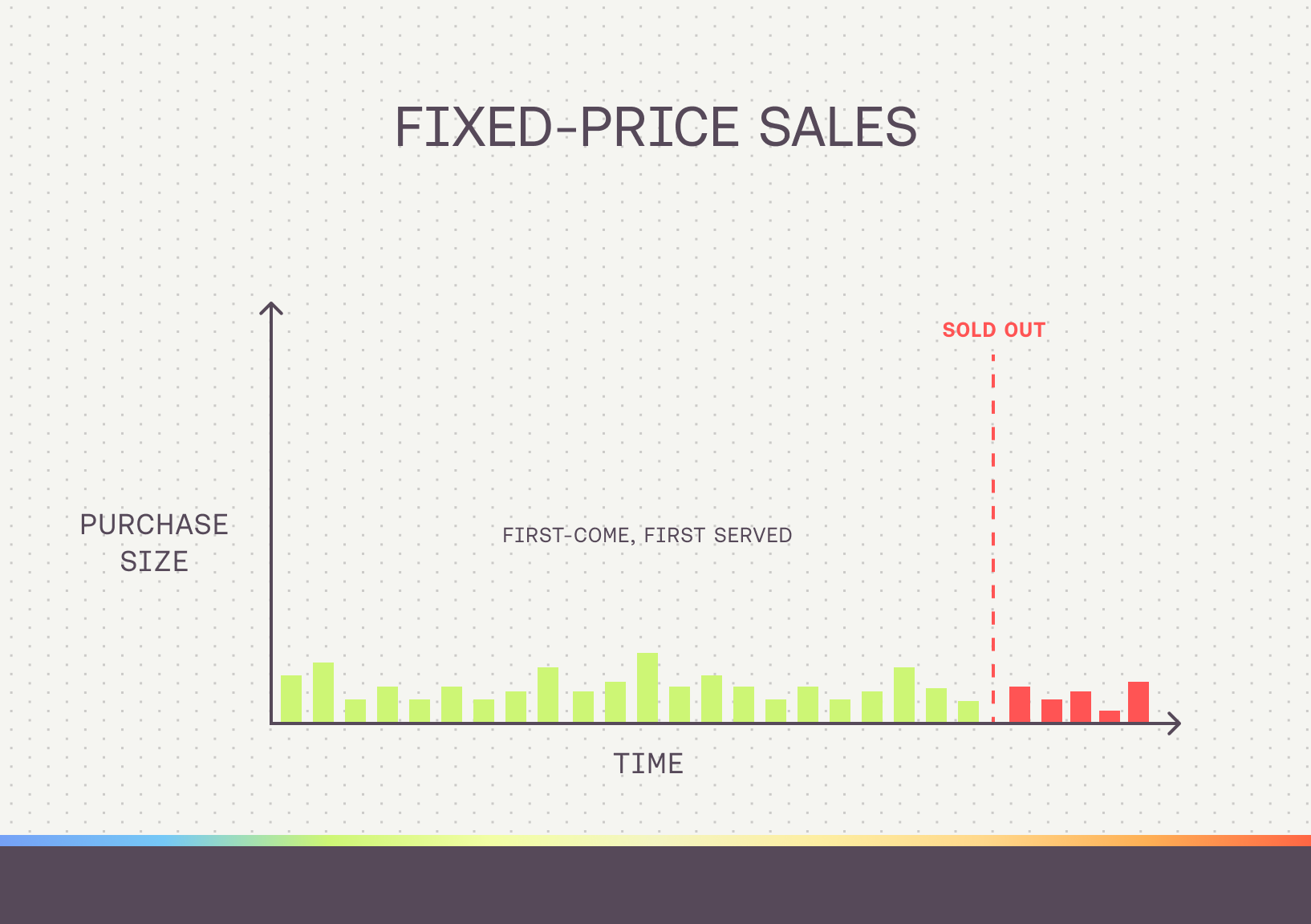

Fixed-Price Sales are a straightforward mechanism that allows participants to purchase tokens at a set price on a first-come, first-served basis. Unlike Sealed-Bid Auctions, the process is simple and direct:

- A project creates a Fixed-Price Sale for their token launch, setting a predetermined price per token and a maximum percentage of the total capacity that can be purchased per transaction.

- Users begin purchasing tokens on a first-come, first-served basis.

- If there are no vesting terms, participants can immediately receive their tokens upon purchase. If vesting is applied, they must wait until the vesting period ends to claim their tokens.

- The auction closes once the entire capacity has been sold.

Fixed-Price Sales often serve as the initial phase in a multi-stage token launch. This strategy helps projects raise initial capital, reward early adopters or community members (particularly if an allowlist is used), and assess market demand at a fixed price.

However, the trade-off is that Fixed-Price Sales create race conditions when used for tokens in high demand. Participation is only guaranteed for users who are able to access the sale in time.