How Sealed-Bid Auctions Work

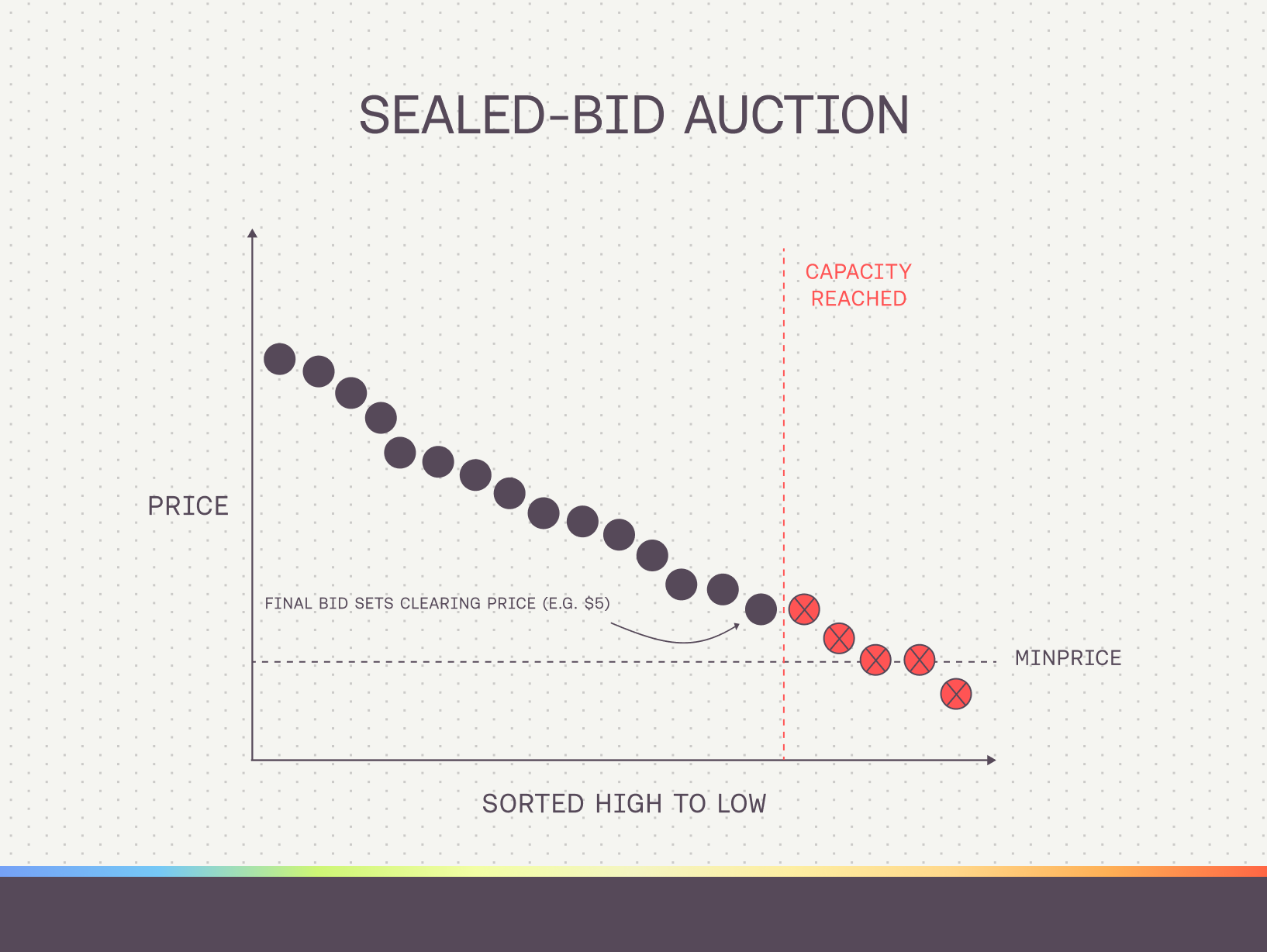

Sealed-Bid Auctions allow users to place private and encrypted bids for a specific quantity of tokens at their preferred price. Once the auction ends, the system decrypts all bids and allocates tokens to the highest bidders down, with the clearing price set by the last successful bid to be filled. For example:

- A project creates a Sealed-Bid Auction for their token launch with a capacity of X amount of tokens.

- Users start bidding on the auction for a X amount of tokens at the price they are willing to pay.

- Once the auction ends, the settlement phase begins where the system will need to decrypt and sort the bids to find a clearing price.

- Next, tokens are allocated to bidders starting from high to low by price until no tokens are left.

- The final bid to receive tokens will set the clearing price, which is the uniform price that all winning bidders will pay.

- Users that bid above the clearing price will receive more tokens than their initial bid amount, while anyone below this clearing price will not receive tokens and be able to claim a refund.

Why Participate in Sealed-Bid Auctions?

Sealed-bid Auctions offer superior price discovery. Since bids are private and encrypted, participants can bid their true price for tokens without fear of being outbid or "sniped" before the auction ends. If their bid wins, they acquire tokens at the most fair price possible due to the auction's settlement process.

Sealed-bid Auctions also remove the influence of timing on token launch results. In other token launch mechanisms like LBPs, there's often a competitive scramble where getting in at the right time is critical to secure the best price. In contrast, Sealed-Bid Auctions ensure that all winning bids placed before the auction closes are cleared at a uniform price.

And finally, post-launch dynamics like price volatility are improved. The factors above help create a smoother price discovery process after the auction, reducing the risk of sharp sell-offs or drastic price swings from early participants seeking quick profits.

How can Losing Bidders Participate?

If a Direct-to-Liquidity Callback is implemented, the payout token will be available for trading immediately after the auction settles. Users can then navigate to the liquidity pool and purchase the token at a price similar to the clearing price — ideally as soon as possible.